IMARC Group, a leading market research company, has recently releases a report titled “Oil Storage Market Report by Material (Steel, Carbon Steel, Fiberglass Reinforced Plastic (FRP), and Others), Product (Open Top, Fixed Roof, Floating Roof, and Others), Application (Crude Oil, Middle Distillates, Gasoline, Aviation Fuel, and Others), and Region 2025-2033.” The study provides a detailed analysis of the industry, including the global oil storage market size, share, trends and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Oil Storage Market Highlights:

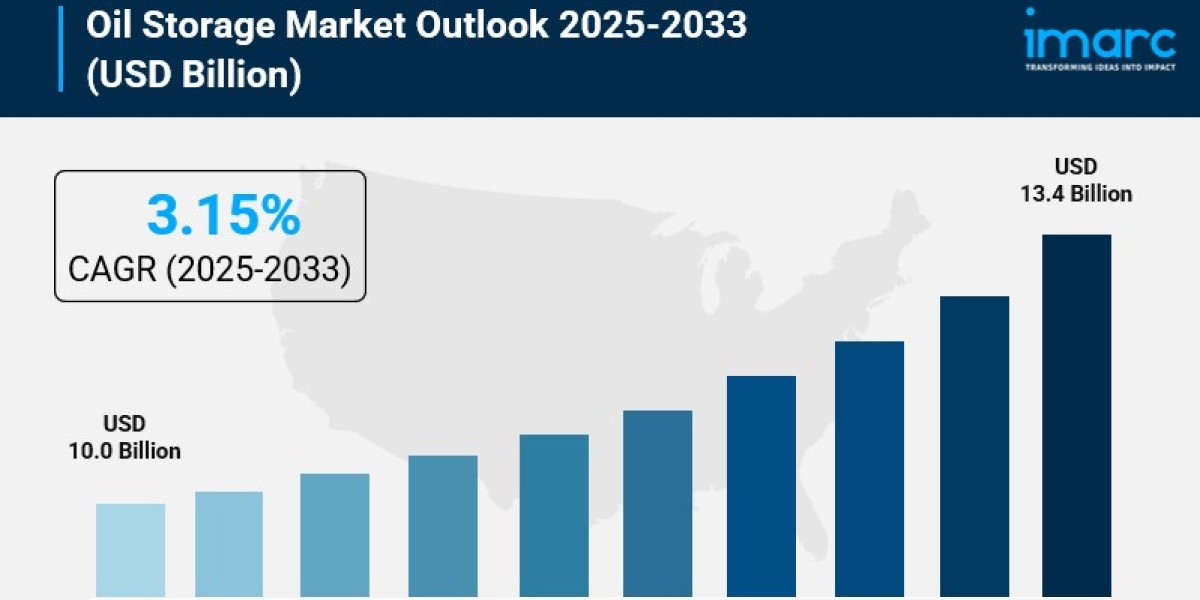

- Oil Storage Market Size: Valued at USD 10.0 Billion in 2024.

- Oil Storage Market Forecast: The market is expected to reach USD 13.4 billion by 2033, growing at an impressive rate of 3.15% annually.

- Market Growth: The oil storage market is experiencing steady growth driven by fluctuating oil prices, expanding energy infrastructure, and strategic reserve developments.

- Technology Integration: Advanced storage solutions incorporating IoT monitoring, automated systems, and digital leak detection are revolutionizing storage facility operations.

- Regional Leadership: Middle East and Africa commands the largest market share, supported by vast oil reserves and extensive storage infrastructure investments.

- Security Enhancement: Growing geopolitical uncertainties are driving nations to invest heavily in strategic petroleum reserves and secure storage facilities.

- Key Players: Industry leaders include Buckeye Partners L.P., Royal Vopak N.V., Energy Transfer LP, and Oiltanking GmbH, which dominate the market with cutting-edge storage solutions.

- Market Challenges: Price volatility management and the need for environmentally compliant storage infrastructure present ongoing challenges.

Request for a sample copy of the report: https://www.imarcgroup.com/oil-storage-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Fluctuating Crude Oil Prices Creating Storage Demand:

The global oil market is experiencing significant price swings, creating unprecedented opportunities for storage operators. When oil prices drop, companies quickly move to stockpile large quantities, betting on future price recoveries. The fluctuating crude oil prices and geopolitical tensions, creating supply and demand imbalances and necessitating storage to manage excess supply or mitigate shortages, are primarily driving the market growth. This dynamic has made storage facilities critical infrastructure for managing market volatility. Recent oil price movements have shown how quickly storage capacity can become a premium commodity, with operators capitalizing on these price differentials through strategic storage and timing.

- Strategic Petroleum Reserves Expansion Accelerating:

Governments worldwide are dramatically expanding their strategic petroleum reserves to ensure energy security during crisis situations. The Asia Pacific region is particularly active in this space, with China leading massive reserve-building programs. Various governments and organizations maintain strategic oil reserves to ensure energy security during crises, is fueling the market growth. These strategic initiatives represent billions in infrastructure investments, creating substantial opportunities for storage facility developers. Countries like India, Japan, and South Korea have announced multi-billion dollar programs to expand their strategic reserves, recognizing oil storage as critical national infrastructure.

- Rising Global Energy Consumption Driving Capacity Needs:

The world's insatiable appetite for energy continues to push oil storage requirements higher. Increasing global energy consumption due to economic growth and industrialization is continually boosting the oil demand and driving the need for expanded storage capacities, which, in turn, is favoring the market growth. Emerging economies are particularly driving this trend, with rapid urbanization and industrial development creating massive new energy demands. Even as renewable energy grows, oil remains essential for transportation, petrochemicals, and industrial processes, ensuring sustained storage demand.

- Geopolitical Tensions Heightening Storage Importance

Recent global events have underscored the critical importance of oil storage in maintaining energy security. Supply chain disruptions from geopolitical conflicts have made storage facilities essential buffers against market shocks. Natural disasters, extreme weather events, and uncertainty in oil-producing regions can disrupt supply chains, emphasizing the need for secure storage, thereby creating a positive outlook for market expansion. The Russia-Ukraine conflict particularly highlighted how quickly energy supply chains can be disrupted, leading countries to prioritize domestic storage capacity as a national security issue.

Oil Storage Market Report Segmentation:

Breakup by Material:

- Steel

- Carbon Steel

- Fiberglass Reinforced Plastic (FRP)

- Others

Carbon steel dominates with the largest market share, remaining the preferred choice for most storage facilities due to its exceptional strength, durability, and cost-effectiveness.

Breakup by Product:

- Open Top

- Fixed Roof

- Floating Roof

- Others

Floating roof holds the largest market share, representing the most advanced storage technology that significantly reduces VOC emissions and evaporation losses while ensuring product quality.

Breakup by Application:

- Crude Oil

- Middle Distillates

- Gasoline

- Aviation Fuel

- Others

Crude oil accounts for the largest segment, reflecting the massive global trade in unrefined petroleum and the need for strategic reserves across all major economies.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Who are the key players operating in the industry?

The report covers the major market players including:

- Buckeye Partners L.P.

- CST Industries Inc.

- Denali Incorporated (National Oilwell Varco Inc.)

- Energy Transfer LP

- L.F. Manufacturing

- Oiltanking GmbH (Marquard & Bahls)

- Royal Vopak N.V.

- Shawcor Ltd.

- Synalloy Corporation

- Snyder Industries LLC

- VTTI B.V.

- Ziemann Holvrieka GmbH.

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=3666&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302