IMARC Group has recently released a new research study titled “Argentina Industrial Valves Market Size, Share, Trends and Forecast by Product Type, Functionality, Material, Size, End Use Industry, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

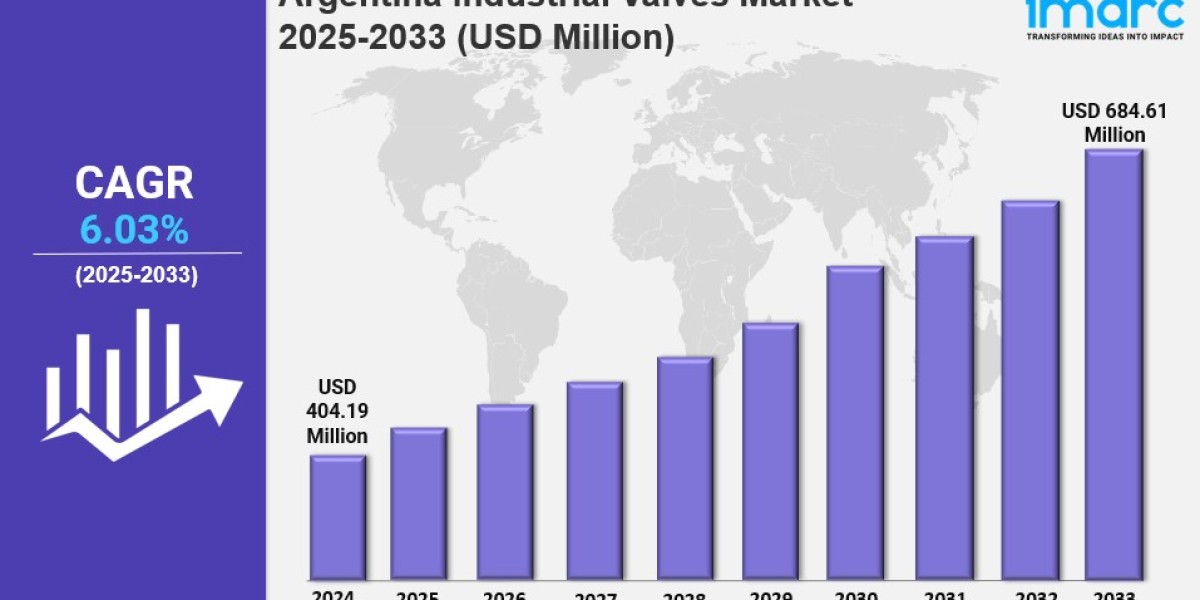

The Argentina industrial valves market size reached USD 404.19 Million in 2024 and is forecasted to reach USD 684.61 Million by 2033, with a CAGR of 6.03% during 2025-2033. Growth is propelled by expanding oil and gas exploration, especially in the Vaca Muerta shale, and modernization in power and water infrastructure. Investments in pharmaceuticals and chemical processing also boost demand, supported by government infrastructure and industrial automation initiatives.

Study Assumption Years

Base Year: 2024

Historical Year/Period: 2019-2024

Forecast Year/Period: 2025-2033

Argentina Industrial Valves Market Key Takeaways

Current Market Size: USD 404.19 Million in 2024

CAGR: 6.03% (2025-2033 forecast period)

Forecast Period: 2025-2033

Industrial modernization programs are driving growth with increased adoption of pneumatically and electrically actuated valves integrated with smart monitoring systems.

The Vaca Muerta shale formation contributes over 70% of Argentina’s natural gas production, needing specialized valves for high-pressure and temperature conditions.

Stringent environmental regulations push the adoption of advanced valve technologies to minimize emissions and enhance operational safety.

Expansion in LNG facilities and petrochemical sectors create demand for large-diameter and specialty valves.

Water utilities’ infrastructure upgrades are driving the need for reliable isolation valves and pressure management systems.

Sample Request Link: https://www.imarcgroup.com/argentina-industrial-valves-market/requestsample

Argentina Industrial Valves Market Growth Factors

The Argentina industrial valves market growth is strongly influenced by ongoing industrial infrastructure modernization and increasing automation efforts, which are driving demand for efficient and reliable flow control solutions across industries. Manufacturers upgrade aging facilities with automated control systems and smart valve technologies. Adoption of pneumatic and electric actuated valves, integrated with digital monitoring systems, aims to improve efficiency, reduce maintenance, and enhance process control. Pharmaceutical and food sectors emphasize hygienic valve designs meeting international standards. Water and wastewater treatment sectors invest heavily in corrosion-resistant valves to prolong equipment life and diminish replacement needs. Government initiatives promote industrial digitalization and energy efficiency by supporting intelligent valve positioners and diagnostic systems enabling predictive maintenance and energy optimization.

The Vaca Muerta shale development plays a pivotal role as it accounts for over 70% of Argentina’s natural gas production, peaking at 3.8 billion cubic feet per day in September 2024. This surge demands specialized high-pressure, high-temperature valve systems including advanced ball, gate, and check valves capable of handling abrasive fluids in hydraulic fracturing and production operations. Expanding the pipeline network and investments in LNG and petrochemical plants further spur demand for large-diameter isolation and specialty cryogenic valves. These developments position Argentina as a strategic energy hub and drive sustained market expansion.

Regulatory compliance and environmental standards also foster market growth. Stringent safety and environmental regulations oblige industries, particularly oil and gas, to adopt advanced valve technologies that reduce emissions and leakage risks. The implementation of fugitive emissions management programs and low-emission packing systems align with international standards. Water utilities are mandated to minimize non-revenue water losses, prompting investments in reliable isolation valves and pressure control systems. Chemical processing plants utilize corrosion-resistant valve materials to prevent environmental contamination. These factors accelerate valve system replacements and procurement shifts, enhancing market growth.