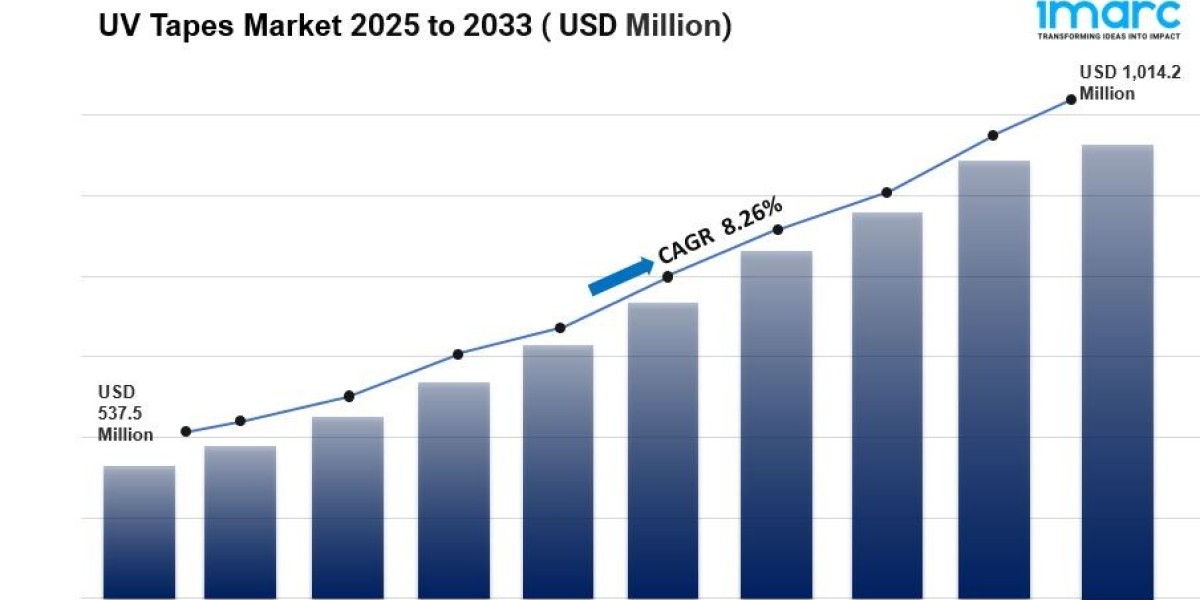

The global UV Tapes Market was valued at USD 537.52 Million in 2024. Forecasts project the market to reach USD 1014.17 Million by 2033, growing at a CAGR of 8.26% from 2025 to 2033. The growth is driven by rising applications in semiconductor manufacturing, electronics assembly, and advancements in adhesive technology, with significant demand for precision microelectronics packaging solutions.

The global UV Tapes Market report is growing steadily, driven by increasing demand from the semiconductor, electronics, and display manufacturing industries. UV tapes play a critical role in wafer dicing, grinding, and packaging processes, offering strong adhesion during production and easy debonding after UV light exposure. The market is benefiting from the rapid expansion of consumer electronics, rising adoption of advanced packaging technologies, and the miniaturization of electronic components. Additionally, the shift toward flexible and printed electronics is further boosting demand for high-performance UV tapes. As manufacturers continue to develop tapes with enhanced thermal stability, improved bonding strength, and compatibility with new materials, the UV tapes market is expected to experience robust growth in the coming years.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

UV Tapes Market Key Takeaways

- Current Market Size: USD 537.52 Million in 2024

- CAGR: 8.26% (2025-2033)

- Forecast Period: 2025-2033

- Asia-Pacific dominated the market with a 41.2% share in 2024, owing to its strong electronics and semiconductor industries.

- The United States led North America with 70.5% market share, driven by the growing flexible display market and adoption in electric and autonomous vehicles.

- Key growth sectors include electronics, semiconductor, automotive, renewable energy, construction, and healthcare industries.

- Increasing use in wafer dicing applications, which held 49.8% market share in 2024, is crucial for semiconductor manufacturing.

Download a sample PDF of this report: https://www.imarcgroup.com/uv-tapes-market/requestsample

Market Growth Factors

The UV tapes market growth is closely linked to the electronics and semiconductor industry expansion. In 2024, the semiconductor industry was valued at USD 694.0 billion and is expected to reach USD 1,221.2 billion by 2033, growing at a CAGR of 6.48%. This drives demand for UV tapes used extensively in chip packaging and wafer dicing operations. The proliferation of consumer electronics such as smartphones and IoT devices further fuels this demand amid rapid urbanization globally.

The automotive industry’s integration of advanced electronics for safety, connectivity, and autonomous technology substantially boosts the UV tapes market. The U.S. electric vehicle market is growing at 27.5% annually and projected to hit USD 386.5 billion by 2032, encouraging use of UV tapes in manufacturing sensors and printed circuit boards. Additionally, solar energy applications and construction infrastructure development, such as India’s USD 9.36 billion increase in PM Awas Yojana funding, support market expansion in renewable energy and building sectors.

The medical and healthcare sector’s rising expenditure is another key factor. Biocompatibility and residue-free removal of UV tapes make them ideal for advanced medical device manufacturing. For instance, India’s healthcare private equity and venture capital investments increased by 220% in early 2024, reflecting rapid sector growth. Technological advances and emphasis on healthcare infrastructure boost UV tape applications, ensuring manufacturing accuracy in diagnostic and therapeutic equipment production.

Market Segmentation

Analysis by Product:

- Polyolefin: Largest product segment in 2024 with a 59.4% market share, favored for excellent adhesion, temperature resistance, and residue-free removal, widely used in semiconductor wafer dicing and display lamination.

- Polyvinyl Chloride

- Polyethylene Terephthalate

- Others

Analysis by Application:

- Wafer Dicing: Dominates the market with approx. 49.8% share in 2024, essential to semiconductor manufacturing for accurate cutting and wafer protection.

- Back Grinding

- Others

Regional Insights

Asia-Pacific dominates the UV tapes market holding over 41.2% share in 2024, driven by major semiconductor manufacturers like Taiwan, South Korea, Japan, and China. The region’s government initiatives, such as South Korea’s semiconductor investment program and China’s Made in China 2025, foster rapid growth. High demand in electronics, automotive (particularly electric vehicles), and renewable energy sectors further propels regional market dominance.

Recent Developments & News

- June 2021: Henkel increased production capacity for UV acrylic hotmelt pressure-sensitive adhesives in Europe to meet growing demand across tapes, labels, and medical sectors.

- February 2024: Kyushu University and Nitto Denko introduced innovative UV-sensitive tape to aid transfer of 2D materials like graphene, enhancing electronics and medical device manufacturing.

- March 2024: Bostik expanded UV acrylic hot melt pressure sensitive adhesives manufacturing in North America, launching a high-performance product portfolio.

- October 2024: H.B. Fuller showcased high-performance UV acrylic PSAs at Labelexpo India 2024, tailored for tapes, labels, and protective films.