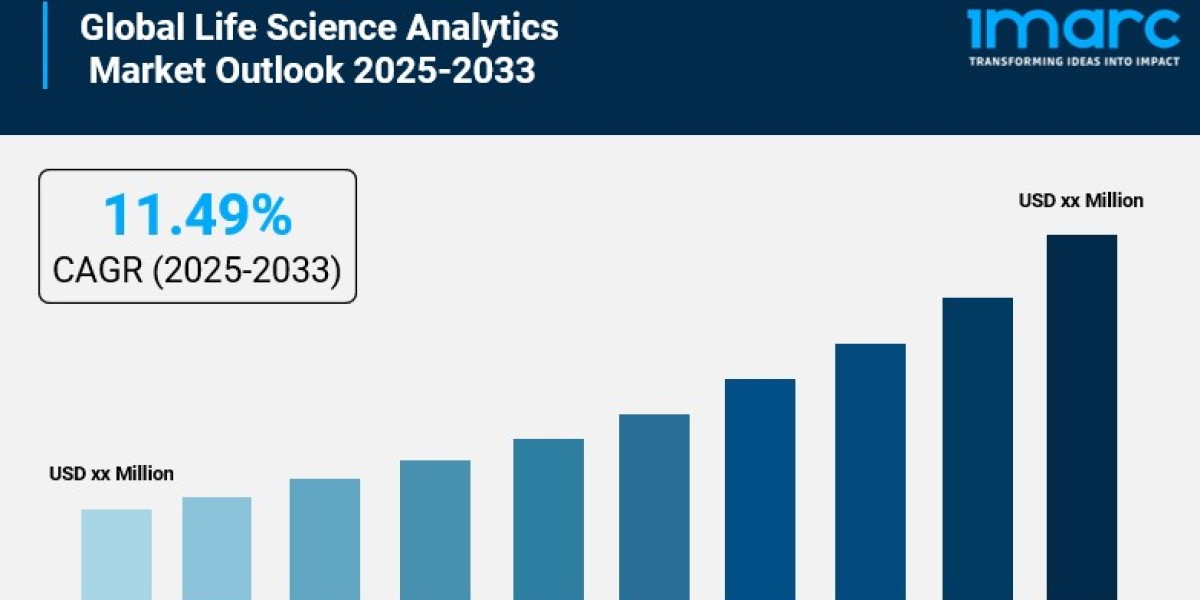

The global life science analytics market is expected to grow at a CAGR of 11.49% during the forecast period from 2025 to 2033. In the base year 2024, the market size was valued at 215 million USD. The growth is driven by advancements in AI and big data, increasing demand for personalized medicine, stringent regulatory demands, and the expansion of pharmaceutical and biotechnology sectors alongside the rising adoption of electronic health records.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Life Science Analytics Market Key Takeaways

- Current Market Size: 215 million USD in 2024

- CAGR: 11.49% during 2025-2033

- Forecast Period: 2025-2033

- The market growth is propelled by the rising demand for personalized medicine and technological advances in AI and big data analytics.

- North America leads the market share due to advanced healthcare IT infrastructure and strong investment in R&D.

- The pharmaceutical sector dominates end use segments, leveraging analytics to optimize supply chain, compliance, and patient outcomes.

- On-demand deployment leads the market, offering scalability and cost advantages over on-premises solutions.

- Research and development is the largest application segment, driven by the need to accelerate drug development and improve clinical outcomes.

Request for a Free Sample Report: https://www.imarcgroup.com/life-science-analytics-market/requestsample

Market Growth Factors

The escalating demand for personalized medicine is the primary factor that drives the life science analytics market. Advanced technologies in medicine allow precise data analysis to find patterns that lead to personalized treatments, which in turn, improve patient outcomes and save costs. An example is the precision medicine initiative started in 2015 and supported by a $215 million investment in 2016, which aims at speeding up biomedical discoveries and providing clinicians with new tools, thereby highlighting the sector's focus on personalized healthcare.

Regulatory compliance and risk management also represent major factors that significantly drive the market. Analytics strategies help pharmaceutical and biotechnology companies to comply with regulations, reduce risks, and improve product quality. Real-time monitoring capabilities bring deep insights that facilitate enforcement cost reduction and process improvement. This factor contributes to the growth of company performance, thus pushing market revenue further.

One of the other main factors that lead to market demand is the technological advancements, especially in big data analytics and artificial intelligence (AI). These technologies help to handle large amounts of data quickly and perform complex market analyses, thus facilitating the development of new therapies and sophisticated clinical trials. The use of these technologies deepens and scales data solutions, thereby resulting in a faster market growth and more possibilities in life science analytics.

Market Segmentation

By Type:

- Reporting,

- Descriptive,

- Predictive,

- Prescriptive

Descriptive is the largest segment, focusing on historical data analysis for trend identification, aiding strategic and operational decisions.

By Component:

- Software,

- Services

Services hold the largest share, covering consulting, implementation, and support critical for integrating analytics into workflows.

By Deployment Mode:

- On-demand,

- On-premises

On-demand leads due to scalability, flexibility, and lower ongoing costs offered by cloud-based solutions.

By Application:

- Research and Development,

- Sales and Marketing Support,

- Supply Chain Analytics,

- Pharmacovigilance (PV),

- Others

Research and Development dominates, driven by needs to speed drug development and improve trial outcomes.

- By End Use:

- Medical Devices,

- Pharmaceutical,

- Biotechnology,

- Others

Pharmaceutical accounts for the largest market, leveraging analytics extensively from drug discovery through commercialization.

By Region:

- North America,

- Asia Pacific,

- Europe,

- Latin America,

- Middle East and Africa

North America leads globally due to advanced healthcare systems, strong R&D funding, and regulatory support.

Regional Insights

North America holds the biggest share in the life science analytics market and therefore, it is the market leader. Besides, this leadership is supported by a well-developed healthcare system, a significant investment in scientific research, and strong regulatory frameworks that facilitate healthcare IT. The adoption of advanced technology and hefty spending on healthcare IT are the pillars that uphold North America's leading position. In the region, a strong momentum for growth is still visible which is primarily driven by the broad implementation of electronic health records (EHRs) and personalized medicine programs.

Recent Developments & News

Salesforce rolled out its Life Sciences Partner Network in May 2025 with the aim of fast-tracking the use of its HIPAA-ready, GxP-compliant Life Sciences Cloud platform, thus facilitating the connection of pharma and medtech companies with certified partners for AI deployment and data integration.

Clarivate Plc launched DRG Fusion, a revolutionary life sciences analytics platform, powered by integrated real-world data in January 2025. The platform provides biopharma and medtech companies with the ability to optimize commercial strategies and improve patient outcomes through AI-driven features.

Oracle unveiled its AI-powered cloud solution, Oracle Analytics Intelligence for Life Sciences, in October 2024, to rapidly unify analysis of diverse data sources in clinical research and care. The solution offers real-world data integration and supports secure EHR-agnostic data analysis.

On March 12, 2024, Oracle revealed upgrades to Oracle Health Data Intelligence with a generative AI service as the major feature, aimed at increasing care management efficiency.

On November 30, 2023, Wipro Limited joined forces with Amazon Web Services (AWS) to life sciences industry laboratory processes evolution, addressing inefficiencies and and high costs.

In July 2022, Infosys acquired BASE life science, reinforcing its commitment to cloud-first digital platforms and data-driven improvements in clinical trials and drug development.