Market Overview

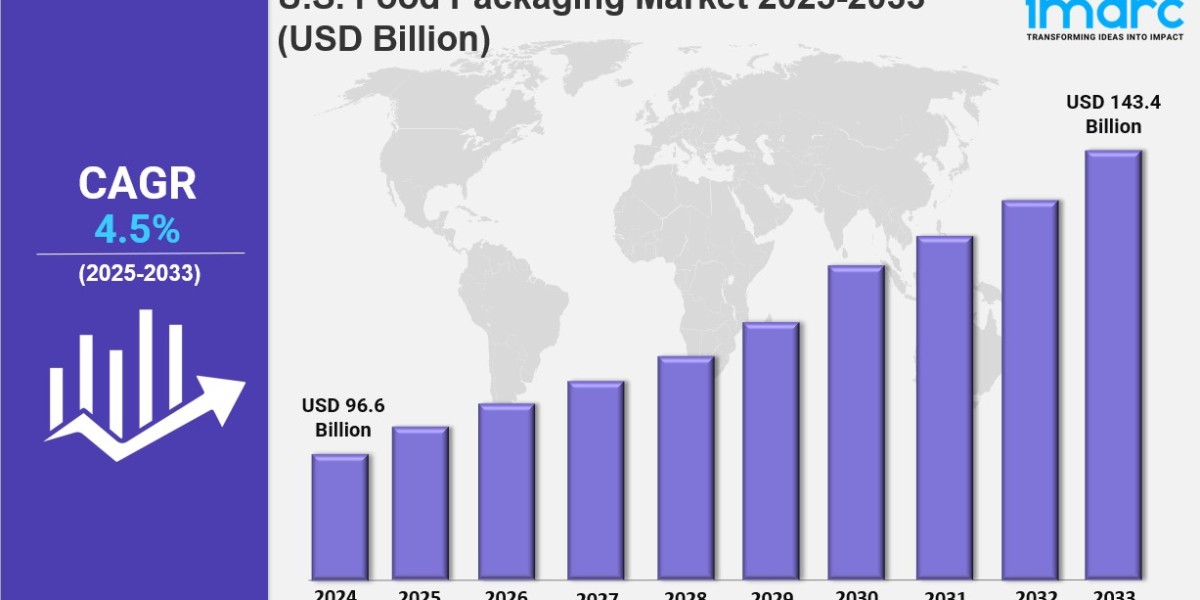

The U.S. food packaging market was valued at USD 96.6 Billion in 2024 and is projected to reach USD 143.4 Billion by 2033. The market is expected to grow at a CAGR of 4.5% during the forecast period 2025-2033. Growth is driven by rising demand for convenience foods, rapid technological advancements in packaging, significant e-commerce growth, increased focus on sustainability, and heightened health awareness.

Study Assumption Years

● Base Year: 2024

● Historical Year/Period: 2019-2024

● Forecast Year/Period: 2025-2033

U.S. Food Packaging Market Key Takeaways

● Current Market Size: USD 96.6 Billion in 2024

● CAGR: 4.5% (2025-2033)

● Forecast Period: 2025-2033

● Convenience food demand is increasing with ready-to-eat meals, frozen foods, and snacks gaining popularity.

● Packaging innovations include resealable pouches, single-serve containers, and microwaveable packaging for ease of use.

● Technological advancements like modified atmosphere packaging (MAP), vacuum packaging, and smart packaging with sensors enhance freshness and safety.

● The growth of e-commerce and online food delivery services drives demand for specialized, durable, and leak-proof packaging.

● There is a major shift toward sustainable and biodegradable packaging due to environmental concerns and regulatory policies.

Sample Request Link: https://www.imarcgroup.com/united-states-food-packaging-market/requestsample

Market Growth Factors

The flow cytometry market in the US is expected to grow owing to the increasing incidences of cancer, accurate cancer detection and treatment assessment provided by flow cytometry. The growing application of advanced flow cytometry for tumor staging, mutation profiling, and personalized medicine in cancer research is expected to increase the market growth. Additionally, the rising adoption of targeted therapy and immunotherapy in cancer treatment is further contributing to the expansion of the U.S. Flow Cytometry Market Share. Consumers seek packaging that keeps up with their increasingly mobile lifestyles. This also augurs well for the market growth.

Technologies such as MAP and vacuum packaging slow down the rate of deterioration and spoilage by controlling the levels of gases like oxygen and moisture in packaged products, further contributing to market growth. The MAP market throughout the Americas is estimated to reach USD 7.79 billion by 2026. Innovations such as temperature sensors and freshness indicators inform in real time about the food's conditions during the transportation and storage steps. Investing money in research and development allows for smart, durable and low-cost packaging.

E-commerce growth and online food delivery growth has increased specialized food packaging demand such as takeout containers. The online food delivery market in the United States is expected to grow at a rate of 9.8% CAGR by 2032 and reach $68.6 billion. Thus, it needs to be leak-proof, strong, insulated, and in a form that is easy for the consumer to handle during home delivery. Packaging is being developed for branding purposes in addition to functional requirements. Increasing environmental concerns have also led to a growing demand for sustainable packaging such as biodegradable, compostable, recyclable and bio-based plastics supported by stricter legislations and regulations in the US.

U.S. Food Packaging Market Segmentation

Analysis by Packaging Type:

● Flexible

● Features plastic films, pouches, wraps; light, customizable, versatile.

● Widely used for snacks, frozen foods, ready-to-eat meals.

● Offers barrier properties resisting moisture, oxygen, contaminants.

● Paper and Paperboard

● Environmentally friendly, biodegradable.

● Used for bakery products, cereals, fast food for appearance and function.

● Materials improved to be water-resistant and greaseproof.

● Rigid Plastic

● Durable and versatile for beverages, dairy, shelf-stable foods.

● Includes containers, bottles, trays.

● Provides physical protection and freshness retention.

● Transparent, light, tamper-evident.

● Glass

● Used for premium products like sauces, baby food, juices, wines.

● High aesthetic and barrier properties.

● Chemically inert, recyclable, sustainable but heavier and costlier.

● Metal

● Includes cans and tins.

● Provides hermetic seal for long-term storage.

● Strength, recyclability, withstands extreme temperatures.

● Others

● Not provided in source.

Analysis by Application:

● Bakery, Confectionary, Pasta, and Noodles

● Packaging emphasizes freshness, texture, flavor.

● Flexible pouches/films reduce moisture.

● Rigid plastic/paperboard ensure durability and stackability.

● Transparent windows and resealable features for convenience.

● Dairy Products

● Rigid plastic containers, flexible pouches/tubes used.

● Protect against contamination and maintain temperature stability.

● Transparent for quality evaluation and single-serve packs for on-the-go.

● Sauces, Dressings, and Condiments

● Leak-proof, tough packaging required.

● Flexible pouches with spouts and rigid glass jars popular.

● Squeeze bottles and portion-controlled packs for user-friendly use.

● Barrier properties prevent oxidation and maintain flavor.

● Snacks and Side Dishes

● Packaging supports portability and freshness.

● Mostly flexible materials like resealable pouches, single-serve packs.

● Transparent windows for visualization.

● Barrier properties to avoid moisture and air penetration.

● Convenience Foods

● Packaging must be durable, portable, microwave compatible.

● Ready-to-eat and frozen foods packed in trays, pouches, cartons.

● Features include easy-peel lids, resealable pouches, compartmentalized trays.

● Meat, Fish, and Poultry

● Packaging centered on freshness, safety, shelf life.

● Vacuum sealing and MAP widely used.

● Rigid plastic trays and flexible films with superior barrier.

● Transparent designs allow product inspection.

● Fruits and Vegetables

● Packaging aims to preserve freshness, reduce spoilage.

● Flexible films, breathable bags, clamshell containers popular.

● Ethylene-absorbing films extend shelf life.

● Transparent packaging ensures product quality visibility.

● Others

● Not provided in source.

Regional Insights

The Northeastern U.S. food packaging market benefits from urbanization, high population density, and demand for convenience meals, supported by a thriving foodservice sector. The region emphasizes sustainable and biodegradable packaging materials. Its high concentration of specialty and organic food markets drives demand for premium, eco-friendly packaging solutions. No specific market share or CAGR percentages provided in source.

Ask an Analyst: https://www.imarcgroup.com/request?type=report&id=20538&flag=C

Recent Developments & News

In April 2024, American Packaging Corporation launched RE™ “Design for Recycle” flexible packaging technology targeting pet food products, including small pouches and large bags. In January 2024, Sealed Air announced the launch of CRYOVAC® compostable overwrap tray at the International Product & Processing Expo (IPPE) in Atlanta, made from biobased, food-contact-grade resin and capable of handling various food value chain conditions.

Key Players

● Amcor plc.

● Berry Global Inc.

● Sonoco Products Company

● Huhtamäki Oyj.

● Winpak Ltd.

● DS Smith PLC

● Sealed Air

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302