IMARC Group, a leading market research company, has recently released a report titled "Biogas Market Report Size, Share, Trends and Forecast by Feedstock, Application, End Use, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the global biogas market Trends, size, trends, growth and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Market Overview

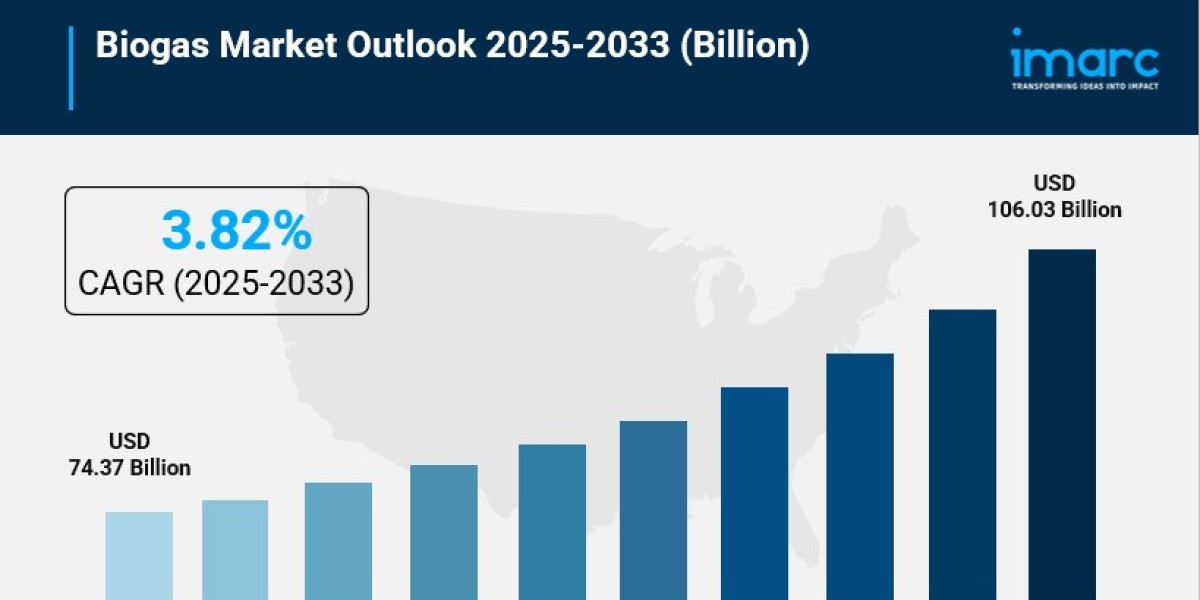

The global biogas market was valued at USD 74.37 billion in 2024 and is expected to reach USD 106.03 billion by 2033, growing at a CAGR of 3.82% during 2025-2033. Growth is driven by rising demand for alternative energy and increased environmental regulations. Europe leads the market with a 40.8% share in 2024, supported by government incentives and technological advancements in energy efficiency and waste management.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Biogas Market Key Takeaways

- Current Market Size: USD 74.37 Billion in 2024

- CAGR: 3.82% during 2025-2033

- Forecast Period: 2025-2033

- Europe dominates the market with a 40.8% share in 2024 due to strong environmental policies and advanced technology adoption.

- Increasing emphasis on circular economy principles boosts use of organic waste as an energy source.

- The U.S. market is driven by policies aiming for net zero emissions and strong investment growth, with 125 new biogas plants inaugurated in 2024.

- Residential sector leads usage, driven by demand for sustainable cooking and heating solutions.

- Technological advancements in anaerobic digestion and biogas upgrading improve yield and scalability.

Request Your Free “Biogas Market” Insights Sample PDF: https://www.imarcgroup.com/biogas-market/requestsample

Market Growth Factors

World-wide, the growth of the biogas market is driven by its role in addressing environmental concerns and impacts of waste accumulation, by converting organic waste, which can be difficult to dispose of, into energy. As circular economy principles become more common, waste as an energy source is used more. AstraZeneca's UK biomethane plant was commissioned in 2025 with the potential to produce up to 100 GWh (365 TJ) of renewable energy per year and meet 20% of the company's global gas demand towards a 2045 net-zero goal. Showing how partnerships and sustainability goals drive market penetration.

Growth is also due to the global arena's need for renewables. In 2024 for example, people demanded energy. This demand rose 2.2% globally. This transition moved the world to biogas and other renewables. Government support offers policy, subsidies, and tax credits for building biogas plants. This helps to ensure energy from different sources, secure energy, and a smaller environmental impact from organic waste. In developing countries, common biogas use addresses air pollution and fuel costs for cooking via substitution that greatly reduces greenhouse gas emissions.

As technology advances, including when it digests anaerobically in order to upgrade biogas, biogas can reach higher methane concentrations to inject into the gas grid or for transport fuel, thus benefiting under economies of scale. New technologies such as microbial electrolysis or photosynthetic CO2 biofixation avoid release of CO2 into the atmosphere with biogas when they generate it. This can increase the 'green' aspects of biogas, make it more cost attractive, and increase its share in international renewable energy markets.

Market Segmentation

Analysis by Feedstock:

- Livestock Manure:

- Sewage:

- Food Waste:

- Crop Residues:

- Energy Crops: These crops, grown for high biomass like maize and sorghum, offer reliable feedstock for anaerobic digestion. They enable optimized biogas production, support supply chain control, and promote circular economy by substituting fossil fuels and reducing emissions.

Analysis by Application:

- Electricity Generation: Leading application with 30.6% market share in 2024. Biogas produces clean power, decreases fossil fuel dependency, and supports grid stability, especially in rural/off-grid areas.

- Biofuel Production:

- Heat Generation:

Analysis by End Use:

- Residential: Market leader in 2024. Biogas replaces conventional fuels like firewood and LPG for cooking/heating, reducing indoor air pollution and promoting waste-to-energy for sustainable domestic energy.

- Commercial:

- Industrial:

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Europe dominates the biogas market, holding over 40.8% share in 2024. The region's leadership stems from stringent environmental regulations, ambitious carbon neutrality goals, advanced biogas technology adoption, and extensive renewable energy investment. Countries such as Germany, France, and the Netherlands spearhead production with robust agricultural feedstock availability. Europe's policies, subsidies, and emphasis on sustainability support broader biogas integration across power, heat, and transport sectors.

Recent Developments & News

In April 2025, a pilot biogas plant was launched in Karachi to convert kitchen and animal waste into biogas and organic fertilizer, processing 10 kg of garbage daily to generate 3 kg of biogas. Wärtsilä secured orders the same month to supply bioLNG systems for two large biogas projects in Finland, each producing 25 tons of bioLNG daily from manure and food waste, targeting operations by 2026. March 2025 saw Kochi launch trial operations at its Brahmapuram compressed biogas plant processing 150 tons of food waste daily for BPCL supply. In January 2025, BPCL partnered with HDMC to develop a compressed biogas plant in Sivalli village, designed to process 144 tons of wet waste daily, with a 25-year operation lease aiming for 5 tonnes of compressed biogas production.

Key Players

- Air Liquide S.A.

- Engie SA

- EnviTec Biogas AG

- Gasum Oy

- Hitachi Zosen Inova AG (Hitachi Zosen Corporation)

- IES BIOGAS srl

- PlanET Biogas Group GmbH

- Scandinavian Biogas Fuels International AB

- TotalEnergies SE

- Wärtsilä Oyj Abp

- WELTEC BIOPOWER GmbH

- Xebec Adsorption Inc.

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=5585&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302