IMARC Group, a leading market research company, has recently released a report titled "Sonar Systems Market Report by Mode of Operation (Active, Passive, Active cum Passive), Product Type (Hull Mounted Sonar, Towed Array Sonar, Sonobuoys, Dipping Sonar, Driver Detection Sonar), Installation (Vessel Mounted, Airborne, Towed, UUV, Hand-Held and Pole Mounted, and Others), Type (Multi Beam, Side Scan, Single Beam, Synthetic Aperture), Application (Military, Hydrographic Charting, Offshore Oil and Gas, Port and Harbour Management, Coastal Engineering, and Others), Material (Piezoelectric Ceramics, Piezoelectric Single Crystals, Magnetostrictive Materials, and Others), and Region 2025-2033." The study provides a detailed analysis of the industry, including the global sonar systems market share, size, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Sonar Systems Market Highlights:

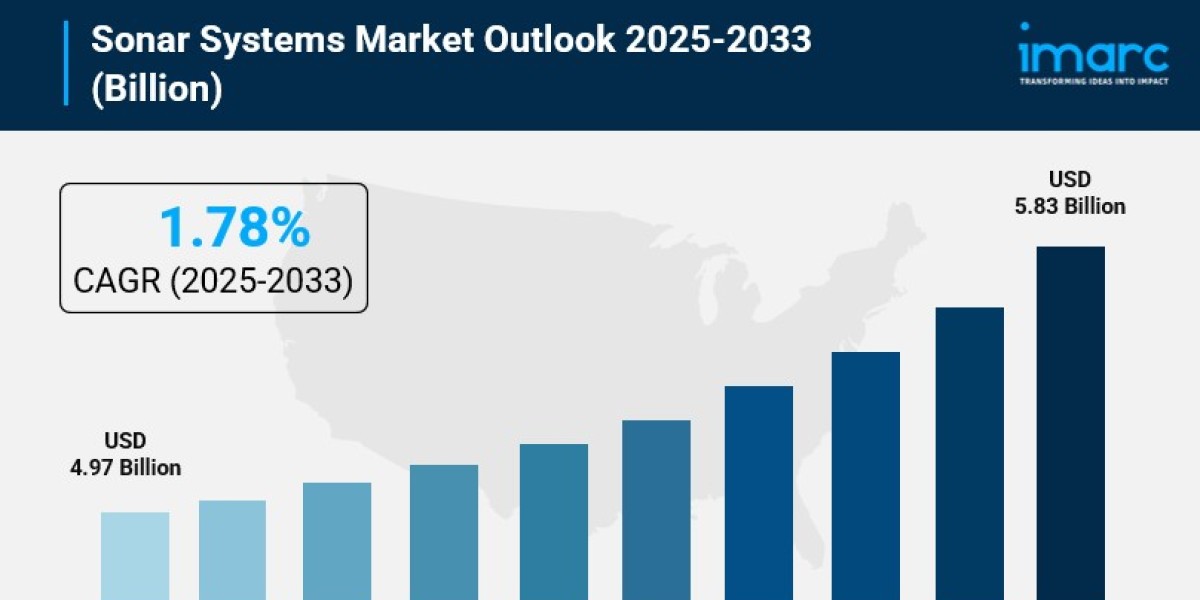

- Sonar Systems Market Size: Valued at USD 4.97 Billion in 2024.

- Sonar Systems Market Forecast: The market is expected to reach USD 5.83 billion by 2033, exhibiting a growth rate of 1.78% during 2025-2033.

- Market Growth: The sonar systems market is experiencing steady growth driven by expanding naval capabilities and increasing demand for maritime security across global defense forces.

- Technology Leadership: Asia-Pacific leads the market with the largest regional share, propelled by massive naval modernization programs in China, India, and other countries investing heavily in underwater surveillance capabilities.

- Defense Dominance: Military applications represent the largest segment, with sonar systems playing critical roles in submarine detection, anti-submarine warfare, and underwater threat identification for navies worldwide.

- Product Innovation: Hull-mounted sonar systems account for the majority of installations, offering reliability and continuous surveillance capabilities for naval vessels operating at high speeds.

- Key Players: Industry leaders include Aselsan A.S, L3Harris Technologies, RTX Corporation, Thales Group, Kongsberg Discovery, Teledyne Marine Technologies, and Northrop Grumman, driving innovation in underwater acoustic systems.

- Market Challenges: High operational costs and the complexity of integrating advanced AI and machine learning capabilities into existing naval infrastructure continue to present hurdles for market expansion.

Claim Your Free “Sonar Systems Market” Insights Sample PDF: https://www.imarcgroup.com/sonar-system-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Rising Demand for Maritime Security and Naval Defense:

Geopolitical tensions within maritime chokepoints and other maritime domains have driven countries to improve their naval capabilities, investing massively in underwater surveillance systems to protect their maritime borders and key maritime assets. These tensions have spurred countries in the region like Vietnam and the Philippines to get newer anti-submarine warfare capabilities. The Indian Navy has been steadily increasing its fleet size in the Indian Ocean region to over 130 warships, and is set to further increase its fleet strength to between 155 to 160 in different categories by 2030. Showing this trend in August 2024, India's second indigenous nuclear-powered ballistic missile submarine, INS Arighat, has advanced sonar and stealth systems and was commissioned. In July 2023 the UK Ministry of Defence made a contract with Ultra Electronics for 30 million British pounds to deliver five Type 2150 hull-mounted sonar systems, to integrate them into the Royal Navy's Type 26 frigates, and to deliver between 2025 and 2032.

- Technological Advancements Transforming Sonar Capabilities:

By integrating artificial intelligence (AI) and machine learning into sonar, targets are detected and tracked while advanced signal processing techniques improve both resolution and classification of targets. In early 2024 Kraken Robotics signed a Cooperative Research and Development Agreement with the U.S. Navy's Naval Undersea Warfare Center to further develop its Synthetic Apertature Sonar (SAS) signal processing technology. In September 2025, the company received 13 million dollars in contracts to supply SAS and battery systems respectively. In October 2023 Thales delivered the first CAPTAS-4 Variable Depth Sonar to the U.S. Navy toward fitting to the first Constellation-class frigates (FFG-62) in 2024. Sonar exists as an advanced anti-submarine warfare (ASW) and mine detection and classification system. It can detect, locate, classify and track even increasingly stealthy submarines. The system is also constantly under development, as in March 2024 Aselsan presented their new low-frequency towed active sonar system.

- Growing Autonomous Underwater Vehicle Deployment:

The market for autonomous underwater vehicles or AUVs has expanded. Some AUVs have advanced sonar systems for use in a wide range of applications. The global AUV market grows rapidly, and most of the world's militaries add unmanned vehicles to their war-fighting capabilities to recognize, to detect mines, and to survey underwater. The DRDO carried out trials of its High Endurance Autonomous Underwater Vehicle at Cochin Shipyard in March 2024. It incorporates front looking and flank array sonar modules designed and developed in India. She can be deployed to missions of a maximum of 15 days, down to a maximum depth of 300 meters. In October 2025, navies of seven countries and three UUV manufacturers used Kraken Robotics' SAS systems in the REPMUS exercise in Portugal. It follows increased integration of advanced sonar with autonomous platforms. In July 2023, India launched the Neerakshi, an autonomous underwater vehicle for mine detection, jointly developed by GRSE and an MSME.

- Expanding Commercial Applications Beyond Defense:

Most of the sonar market is military, but commercial applications also exist. For example, offshore oil and gas companies use sonar extensively for pipeline inspection, seabed mapping and inspection of underwater structures. There is demand from environmental monitoring and marine conservation programs for sonar systems that can assess the health of the marine ecosystem, measure the water depth, determine the consistency of the sediment and monitor pollution sources, without damaging marine life. Passive sonar systems listen to underwater sounds without emitting signals and are used in marine studies and fisheries management. In addition to the defense applications of sonar systems, port and harbor authorities have begun to use the systems to monitor ship traffic, observe the seafloor and patrol security. Hydrographic charting remains important, and sonar systems are used for ocean floor mapping, bathymetric surveying, and nautical charting work across commercial shipping, fishing and recreational boating.

Sonar Systems Market Report Segmentation:

Breakup by Mode of Operation:

- Active

- Passive

- Active Cum Passive

Passive represents the largest segment, preferred for its stealthy approach in both military and commercial applications, enabling submarine detection and marine ecosystem observation without revealing the operator's presence.

Breakup by Product Type:

- Hull Mounted Sonar

- Towed Array Sonar

- Sonobuoys

- Dipping Sonar

- Driver Detection Sonar

Hull mounted sonar dominates the market, integrated directly into vessel hulls to provide continuous underwater surveillance and target detection capabilities even at high speeds, making them essential for naval defense and commercial operations.

Breakup by Installation:

- Vessel Mounted

- Airborne

- Towed

- UUV

- Hand-Held and Pole Mounted

- Others

Airborne installation leads the market, offering rapid coverage of vast areas for anti-submarine warfare, maritime surveillance, and search and rescue operations, with the ability to quickly access remote or difficult-to-reach locations.

Breakup by Type:

- Multi Beam

- Side Scan

- Single Beam

- Synthetic Aperture

Multi beam sonar systems capture the largest market share, utilizing multiple sonar beams to simultaneously capture wide swaths of underwater data, providing efficient mapping of the ocean floor and detailed 3D representations for hydrographic charting, underwater archaeology, and offshore exploration.

Breakup by Application:

- Military

- Hydrographic Charting

- Offshore Oil and Gas

- Port and Harbour Management

- Coastal Engineering

- Others

Military applications account for the largest segment, with sonar systems critical for naval defense, providing submarine detection, underwater threat identification, and anti-submarine warfare capabilities essential for securing coastal waters and maritime borders.

Breakup by Material:

- Piezoelectric Ceramics

- Piezoelectric Single Crystals

- Magnetostrictive Materials

- Others

Piezoelectric ceramics remain the most common material for sonar transducers due to their established reliability, good sensitivity and bandwidth, and suitability for a wide range of applications from underwater navigation to mapping.

Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific commands the largest regional market share, driven by expanding naval capabilities in countries like China and India, substantial investments in maritime infrastructure, and growing commercial activities in offshore oil and gas, fisheries, and underwater research throughout the region.

Who are the key players operating in the industry?

The report covers the major market players including:

- Aselsan A.S

- GeoSpectrum Technologies Inc.

- Japan Radio Co.

- Kongsberg Discovery

- L3Harris Technologies, Inc.

- Navico Group

- Northrop Grumman

- RTX Corporation

- Sonardyne

- Teledyne Marine Technologies

- Thales Group

- TKMS ATLAS ELEKTRONIK GmbH

- Ultra

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=1170&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302