IMARC Group, a leading market research company, has recently released a report titled "Hydraulic Fracturing Market Report by Well Type (Horizontal, Vertical), Fluid Type (Slick Water-based Fluid, Foam-based Fluid, Gelled Oil-based Fluid, and Others), Technology (Plug and Perf, Sliding Sleeve), Application (Shale Gas, Tight Oil, Tight Gas), and Region 2025-2033." The study provides a detailed analysis of the industry, including the global hydraulic fracturing market share, size, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Hydraulic Fracturing Market Highlights:

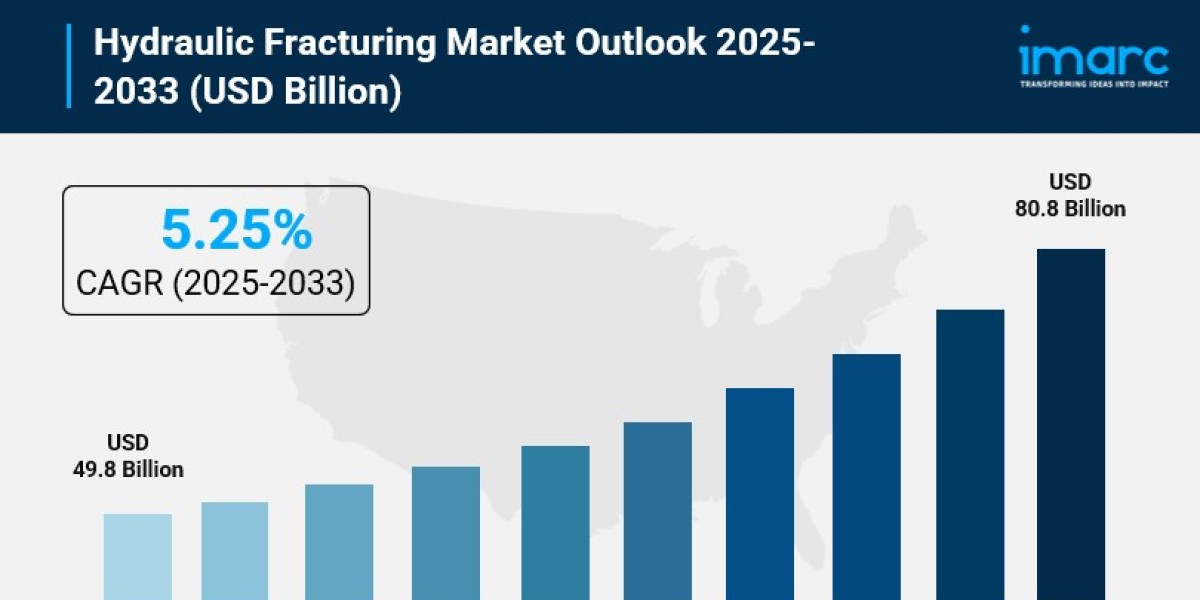

- Hydraulic Fracturing Market Size: Valued at USD 49.8 Billion in 2024.

- Hydraulic Fracturing Market Forecast: The market is expected to reach USD 80.8 billion by 2033, growing at an impressive rate of 5.25% annually.

- Market Growth: The hydraulic fracturing market is experiencing steady expansion driven by surging energy demands and the rapid development of unconventional oil and gas reserves worldwide.

- Technology Integration: Advanced extraction techniques including multi-stage fracturing, real-time monitoring systems, and machine learning applications are transforming operational efficiency and resource recovery.

- Regional Leadership: North America dominates the market, powered by extensive shale reserves and cutting-edge infrastructure supporting large-scale fracking operations.

- Resource Optimization: The growing focus on extracting tight oil and shale gas from low-permeability formations is accelerating demand for sophisticated fracturing solutions.

- Key Players: Industry leaders include Halliburton, SLB, Baker Hughes Company, Liberty Energy, and Weatherford, which continue to push technological boundaries in the sector.

- Market Challenges: Environmental regulations and the need for sustainable fracturing practices remain critical concerns driving innovation in fluid management and emission reduction.

Claim Your Free “Hydraulic Fracturing Market” Insights Sample PDF: https://www.imarcgroup.com/hydraulic-fracturing-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

Surging Global Energy Demand Creating Unprecedented Opportunities:

The world demand for energy continues to build. In mid-November of 2022, there were 8.0 billion people in the world, according to the United Nations, the highest in history. The World Bank states the world's urbanization level is at 56%. This population migration will require increased energy supply, which the International Energy Association has forecast to grow by 1.3% per year into the future until 2040, without policy change. It has become an important technology for easing the development of previously uneconomic unconventional oil and gas resources in shale formations, as cleaner and cheaper energy than coal, helping to meet the dual energy security and climate objectives of many countries. As conventional reserves dwindle, fracking is seen as necessary to meet global energy demand.

Booming Crude Oil Production from Unconventional Reserves:

The oil business is transforming as unconventional oil producers have produced record levels. The United States Energy Information Administration reports that U.S. crude oil produced 12.9 million barrels per day throughout 2022. This growth has, in part, been driven by how the industry evolved to produce tight oil and shale oil from relatively impermeable rock formations in which customary oil extraction is not possible and hydraulic fracturing is required. Conventional oil fields declined slowly. The industry spent billions to develop fracturing technology. The industry economically extracted previously unrecoverable oil. The industry artificially fractured the rock formation. This enabled the oil to flow into wellbores at commercial flow rates. The shift changes global oil supply dynamics and drives demand for advanced fracturing technologies.

Explosive Growth in Shale Gas Development Worldwide:

Shale gas producers extract and produce with projected continual growth in the future, and hydraulic fracturing enables through this process. Shale gas that the United States produced accounted for more than half of total natural gas that was produced by 2015, according to the United States Energy Information Administration. The shale boom that began within North America is spreading to other countries. Canada, China, and Argentina have devoted important funds to the exploration and development of their shale gas resources. This trend replicates across the world as countries strive to become energy independent and try to limit energy that they import. Every shale gas project requires investment in complex fracturing services, leading to sustained demand across many markets. These have allowed gas-rich countries that previously lacked access to markets to change their energy security perspectives and energy mix.

Revolutionary Technology Advancements Driving Efficiency:

The hydraulic fracturing industry is also undergoing a technological renaissance in collaboration with academic and research institutions, through the development of new monitoring technologies and applications such as tracers, fiber optics, downhole cameras, microseismic monitoring to optimize fluid volumes and fracture designs, and, more recently, machine learning applications for using real-time fracturing data to optimize fracturing parameters and the scheduling of materials. These systems provide operators with visual access to conditions below ground, including hydrocarbon-bearing formations, and multi-stage fracturing is becoming the standard practice to maximize effective surface area contact with productive formations, minimizing surface footprint. Artificial intelligence-based early warning systems help reduce operational problems for well developments before they happen. Their adoption marks more than the incremental enhancement of existing processes; it represents a fundamental break from the past, making the way the industry extracts resources safer, more efficient and affordable.

Hydraulic Fracturing Market Report Segmentation:

Breakup by Well Type:

- Horizontal

- Vertical

Horizontal wells dominate the market, offering superior resource extraction efficiency by maximizing contact with hydrocarbon-bearing formations and delivering significantly higher production rates compared to traditional vertical drilling.

Breakup by Fluid Type:

- Slick Water-Based Fluid

- Foam-Based Fluid

- Gelled Oil-Based Fluid

- Others

Slick water-based fluid leads the market due to its cost-effectiveness and exceptional performance in shale formations, where its low viscosity enables faster pumping and optimal proppant placement in large-scale operations.

Breakup by Technology:

- Plug and Perf

- Sliding Sleeve

Plug and perf technology commands the largest share, valued for its proven efficiency in targeting specific zones within wells, maximizing hydrocarbon recovery while maintaining operational flexibility across diverse geological conditions.

Breakup by Application:

- Shale Gas

- Tight Oil

- Tight Gas

Tight oil represents the largest application segment, driven by vast unconventional oil reserves requiring advanced fracturing techniques and sustained high demand for crude oil production from low-permeability formations.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Who are the key players operating in the industry?

The report covers the major market players including:

- ADNOC Drilling Company PJSC

- Baker Hughes Company

- Calfrac Well Services Ltd

- Halliburton

- Liberty Energy, Inc.

- National Energy Services Reunited Corp.

- NexTier Completion Solutions

- Profrac

- ProPetro Services, Inc

- SLB

- Weatherford

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=4829&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302