Market Overview:

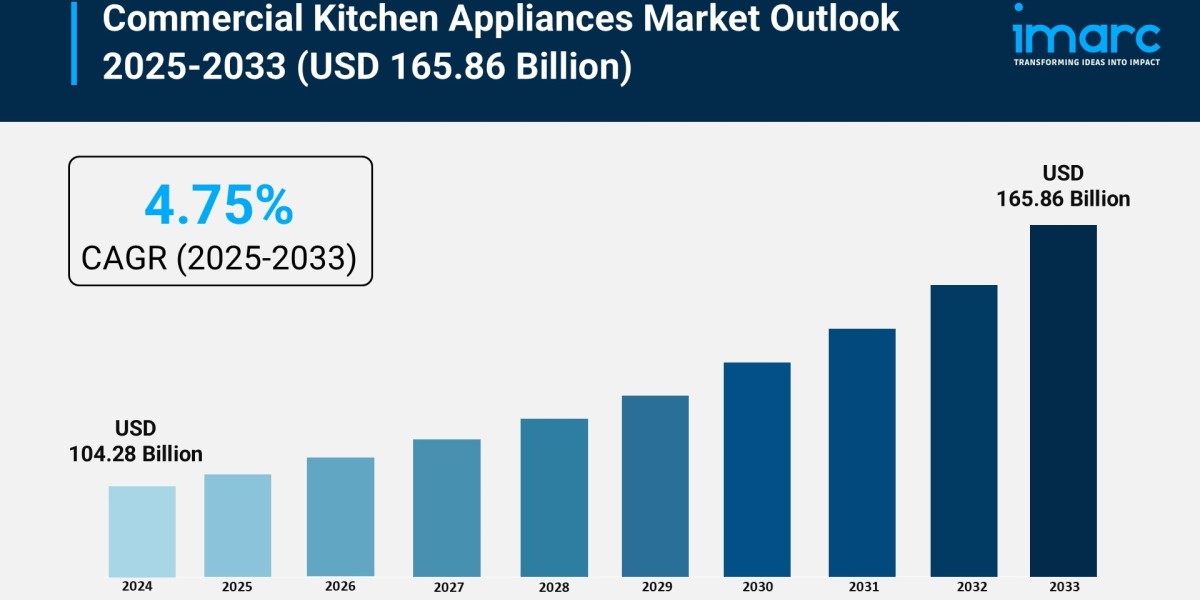

The commercial kitchen appliances market is experiencing rapid growth, driven expansion of the quick service restaurant (QSR) sector, focus on energy efficiency and sustainability, and technological integration and automation. According to IMARC Group's latest research publication, "Commercial Kitchen Appliances Market Size, Share, Trends and Forecast by Type, Distribution Channel, Application, and Region, 2025-2033", The global commercial kitchen appliances market size was valued at USD 104.28 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 165.86 Billion by 2033, exhibiting a CAGR of 4.75% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/commercial-kitchen-appliances-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Commercial Kitchen Appliances Market

- Expansion of the Quick Service Restaurant (QSR) Sector

The rapid global proliferation of Quick Service Restaurants (QSRs) and other fast-casual dining formats is a primary growth driver for commercial kitchen appliances. The demand for speedy, high-volume food preparation equipment is surging, particularly in emerging economies where urbanization and changing consumer lifestyles increase the preference for ready-to-eat meals. This sector's dominance is evidenced by its large share of the market, driven by chains like McDonald's, Burger King, and local franchises that require robust, standardized equipment such as high-capacity fryers, conveyor ovens, and automated dispensing machines. Furthermore, the rise of cloud kitchens and delivery services, facilitated by platforms like Uber Eats and DoorDash, directly translates to increased demand for dedicated, heavy-duty commercial cooking appliances capable of handling immense order volumes and ensuring consistent quality for off-premise dining.

- Focus on Energy Efficiency and Sustainability

Increasing regulatory pressure and corporate sustainability goals are fueling the demand for energy-efficient commercial kitchen appliances. Governments and regional bodies worldwide are implementing stricter energy performance standards, encouraging operators to replace older equipment with modern, low-consumption models. For example, the use of induction cooktops and high-efficiency combination ovens is becoming a standard practice as they significantly reduce energy use compared to traditional gas or electric counterparts. Companies like Rational AG and Electrolux are consistently introducing new lines of Energy Star-rated equipment to meet this demand. This shift is also supported by financial incentives and loan programs, like those offered by the U.S. Small Business Administration (SBA), which help food service operators finance the purchase of modern, high-cost, yet energy-saving, commercial machinery.

- Technological Integration and Automation

The integration of Internet of Things (IoT) and Artificial Intelligence (AI) into kitchen equipment is driving a wave of modernization and replacement across the industry. Manufacturers are embedding sensors and connectivity features into ovens, refrigerators, and dishwashers, turning them into "smart" appliances that offer predictive maintenance, remote diagnostics, and recipe programming. For instance, companies such as Hoshizaki Corporation and Vulcan are developing connected systems that allow kitchen managers to monitor equipment performance and energy consumption from a central dashboard. This technological advancement improves operational efficiency, reduces labor costs, and ensures food quality and safety standards are met, which is particularly critical for large hotel chains and institutional catering services with multiple locations.

Key Trends in the Commercial Kitchen Appliances Market

- The Rise of Smart, Connected Kitchens

A key emerging trend is the transformation of commercial spaces into fully smart and connected kitchens. This goes beyond individual smart appliances to creating an interconnected ecosystem where all equipment communicates with one another and with kitchen management software. A real-world application is the use of AI-powered ventilation systems that automatically adjust fan speed based on the detected cooking activity, optimizing energy consumption and air quality. For instance, a commercial oven might automatically send temperature and cycle completion data to a central system that manages food inventory and scheduling, allowing a large restaurant to track exactly how many batches of a specific item have been cooked and when maintenance might be required on the equipment, thereby reducing downtime and improving overall throughput.

- Modular and Multifunctional Equipment Design

The market is seeing a distinct shift towards modular, multifunctional appliances that maximize space utilization, especially critical for smaller urban restaurants and the proliferating cloud kitchen model. This trend addresses the need for operational flexibility and a smaller physical footprint. A prominent example is the widespread adoption of combination ovens (Combi-Ovens) which can perform multiple cooking functions like steaming, convection baking, and roasting in a single unit, replacing several pieces of traditional equipment. Similarly, undercounter refrigeration units are now often designed with interchangeable drawers and shelves to adapt to changing menu needs, allowing a single kitchen space to quickly transform its operations to handle a greater variety of culinary tasks and a broader menu with minimal construction or fixed cost.

- Emphasis on Food Safety and Hygiene Technology

New technologies specifically targeting enhanced food safety and hygiene are quickly becoming a purchasing prerequisite for commercial operators. This involves appliances with advanced self-cleaning cycles and materials designed to inhibit bacterial growth. A clear example is the use of ozone technology in commercial dishwashers and specialized blast chillers that rapidly cool food to safe storage temperatures, minimizing the time food spends in the "danger zone" for bacterial growth. Major food service companies are adopting these solutions to reduce the risk of foodborne illnesses. Furthermore, the development of anti-microbial coatings on frequently touched appliance surfaces, such as door handles and control panels, is a growing application that provides an added layer of protection, demonstrating a clear investment in public health and operational risk mitigation.

Leading Companies Operating in the Global Commercial Kitchen Appliances Industry:

- Alto-Shaam Inc.

- American Range Corporation

- Carrier Global Corporation

- Duke Manufacturing Company

- Electrolux AB

- G.S. Blodgett Corporation (The Middleby Corporation)

- Hamilton Beach Brands Inc.

- Hoshizaki Corporation

- Interlevin Refrigeration Ltd.

- MEIKO Maschinenbau GmbH & Co. KG

- The Vollrath Company LLC

- True Manufacturing Co. Inc.

Commercial Kitchen Appliances Market Report Segmentation:

By Type:

- Refrigerators

- Cooking Appliances

- Cooktop and Cooking Ranges

- Ovens

- Dishwashers

- Others

Refrigerators lead the market in 2024 with 16.8% share, valued for their ability to keep food fresh, energy efficiency, and customizable capacities.

By Distribution Channel:

- Offline

- Online

Offline sales dominate with 78.7% market share, driven by product availability, customer experience enhancements, and the ability to test products before purchase.

By Application:

- Quick Service Restaurant (QSR)

- Railway Dining

- Institutional Canteen

- Resort and Hotel

- Hospital

- Full Service Restaurant (FSR)

- Others

Quick Service Restaurants (QSR) capture 30.2% market share, focusing on quick service, minimal preparation, menu innovation, and competitive pricing.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America holds over 35.0% market share, fueled by the growing number of food establishments and the adoption of advanced kitchen appliances for efficiency and reduced waste.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302