IMARC Group, a leading market research company, has recently released a report titled "Livestock Insurance Market Report by Coverage (Mortality, Revenue, and Others), Animal Type (Bovine, Swine, Sheep and Goats, and Others), Distribution Channel (Direct, Agency/Broker, Bancassurance), and Region 2025-2033." The study provides a detailed analysis of the industry, including the global livestock insurance market share, size, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Livestock Insurance Market Highlights:

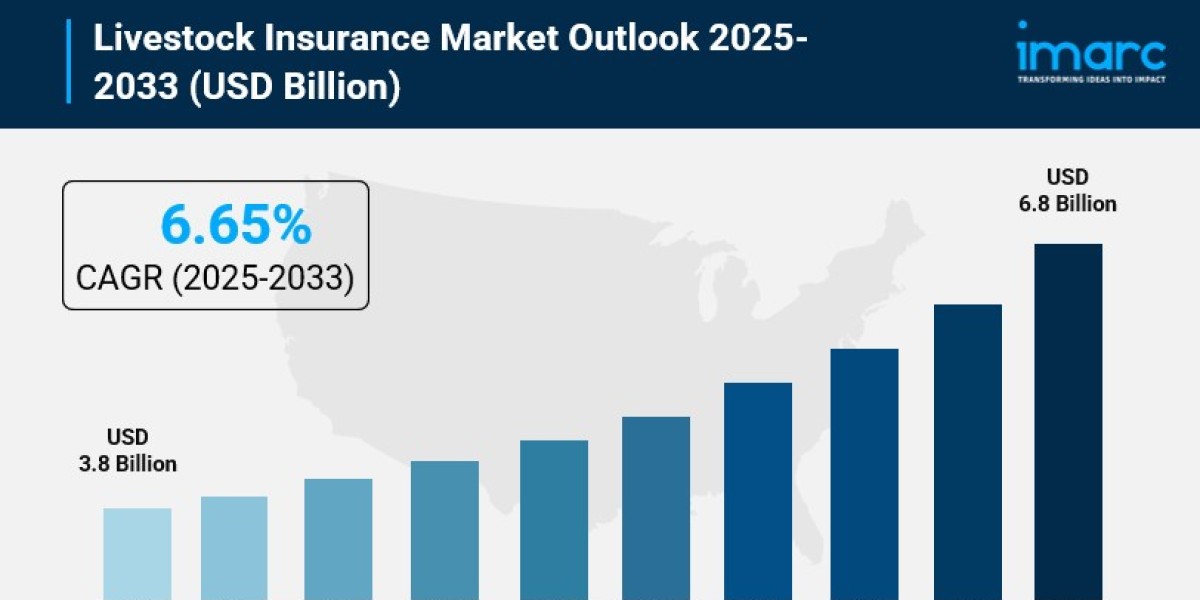

- Livestock Insurance Market Size: Valued at USD 3.8 Billion in 2024.

- Livestock Insurance Market Forecast: The market is expected to reach USD 6.8 billion by 2033, growing at an impressive rate of 6.65% annually.

- Market Growth: The livestock insurance market is experiencing robust growth driven by the increasing prevalence of disease outbreaks, rising consumer preferences towards animal-based products, and growing awareness about animal health and well-being.

- Government Support: Public subsidies for livestock insurance have skyrocketed, with annual insurance subsidies increasing from USD 3.8 Million to USD 411.3 Million, reflecting strong governmental commitment to protecting agricultural livelihoods.

- Regional Leadership: North America dominates the market, benefiting from large-scale commercial farming operations and comprehensive cattle insurance programs covering mortality, accidents, and forage protection.

- Technology Integration: Leading insurers are incorporating advanced technologies including IoT sensors, predictive analytics, and blockchain systems to enable real-time animal health monitoring and streamlined claims processing.

- Key Players: Industry leaders include AXA XL, Nationwide Mutual Insurance Company, HDFC ERGO General Insurance, ICICI Lombard, and The Hartford, which dominate the market with comprehensive coverage solutions.

- Market Challenges: Climate change impacts, disease outbreak management, and the need for affordable premium structures for smallholder farmers present ongoing challenges.

Claim Your Free “Livestock Insurance Market” Insights Sample PDF: https://www.imarcgroup.com/livestock-insurance-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Rising Value of Livestock Assets Creating Protection Demand:

The global livestock sector is experiencing unprecedented asset value growth, driven by expanding populations and shifting dietary patterns toward protein-rich foods. As farmers invest heavily in premium breeding stock and commercial herds, the financial stakes have become substantially higher. This trend is pushing livestock owners to seek comprehensive insurance protection for their valuable animals. Modern commercial operations often maintain cattle herds valued at several million dollars, making insurance coverage a critical component of farm financial planning. The growing value of individual animals, particularly in dairy and beef cattle operations, means that a single mortality event can result in losses exceeding tens of thousands of dollars, making insurance an essential risk management tool.

- Government Subsidies Accelerating Insurance Adoption:

Governments worldwide are stepping up support for agricultural risk management through substantial insurance subsidies. In India, the Livestock Insurance Scheme provides direct financial assistance to smallholder farmers, helping them secure coverage against unexpected losses without bearing the full premium burden. Similarly, the U.S. Livestock Risk Protection program enables producers to insure themselves against market price drops, with government subsidies making coverage affordable. These initiatives are building strong public-private partnerships that extend insurance access to farmers who previously couldn't afford protection. Countries including China have also developed government-sponsored programs aimed at subsidizing premium payments, recognizing that livestock insurance is crucial for rural economic stability and food security.

- Disease Outbreaks Driving Insurance Necessity:

The livestock sector faces mounting pressure from disease threats that can devastate entire herds within days. Outbreaks of foot and mouth disease, avian influenza, and African swine fever have caused billions in losses across multiple regions, highlighting the vulnerability of uninsured operations. Farmers are increasingly recognizing that insurance isn't optional but essential for survival. When disease strikes, insurance provides the financial cushion needed to manage expenses related to treatment, quarantine measures, herd depopulation, and eventual restocking. The unpredictable nature of disease emergence, combined with the speed at which pathogens can spread through modern high-density livestock operations, has made insurance coverage a fundamental component of biosecurity planning.

- Climate Change Amplifying Weather-Related Risks:

Extreme weather events are hitting livestock operations with increasing frequency and severity. Droughts, floods, hurricanes, and unseasonable temperature extremes are causing substantial livestock mortality and infrastructure damage across all regions. Farmers in traditionally stable climates are now facing weather patterns that threaten their animals and operations in ways they've never experienced before. Insurance provides critical financial support when weather disasters strike, enabling farmers to recover losses, repair damaged facilities, and rebuild their herds. The unpredictability of climate-related events means farmers can no longer rely on historical weather patterns to guide their risk management strategies, making insurance protection increasingly essential for maintaining business continuity and financial stability.

Livestock Insurance Market Report Segmentation:

Breakup by Coverage:

- Mortality

- Revenue

- Others

Mortality coverage dominates the market, serving as the primary insurance choice for livestock owners seeking protection against animal death from accidents, illness, disease, natural disasters, and theft.

Breakup by Animal Type:

- Bovine

- Swine

- Sheep and Goats

- Others

Bovine represents the largest segment, driven by the high value of cattle operations and the substantial financial exposure associated with dairy and beef production systems.

Breakup by Distribution Channel:

- Direct

- Agency/Broker

- Bancassurance

Direct distribution channels lead the market, as insurance companies increasingly engage farmers and livestock owners through online platforms, call centers, and in-person interactions without intermediaries.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Who are the key players operating in the industry?

The report covers the major market players including:

- AXA XL

- FBL Financial Group, Inc

- Future Generali India Insurance Company Ltd.

- HDFC ERGO General Insurance Company

- Howden Insurance & Reinsurance Brokers (Phil.), Inc.

- HUB International Limited (Hellman & Friedman LLC)

- ICICI Lombard General Insurance Company Limited

- Liberty Mutual Insurance Company (Liberty Mutual Group Inc.)

- Lloyd's

- Nationwide Mutual Insurance Company

- The Hartford

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=8024&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302