The Polyester Staple Fiber (PSF) market revolves around the production and application of short-length polyester fibers that are widely used in textiles, apparel, home furnishings, non-woven fabrics, and industrial products. PSF is favored for its durability, versatility, and cost-effectiveness, making it a preferred choice across various industries. The market is expanding steadily, driven by rising demand from the textile and apparel sectors, increasing adoption in non-woven applications such as hygiene products and automotive interiors, and growing investments in polyester production capacities globally. Detailed analysis of the Polyester Staple Fiber Market Forecast indicates continued growth as manufacturers focus on innovation, sustainability, and meeting evolving consumer demands worldwide.

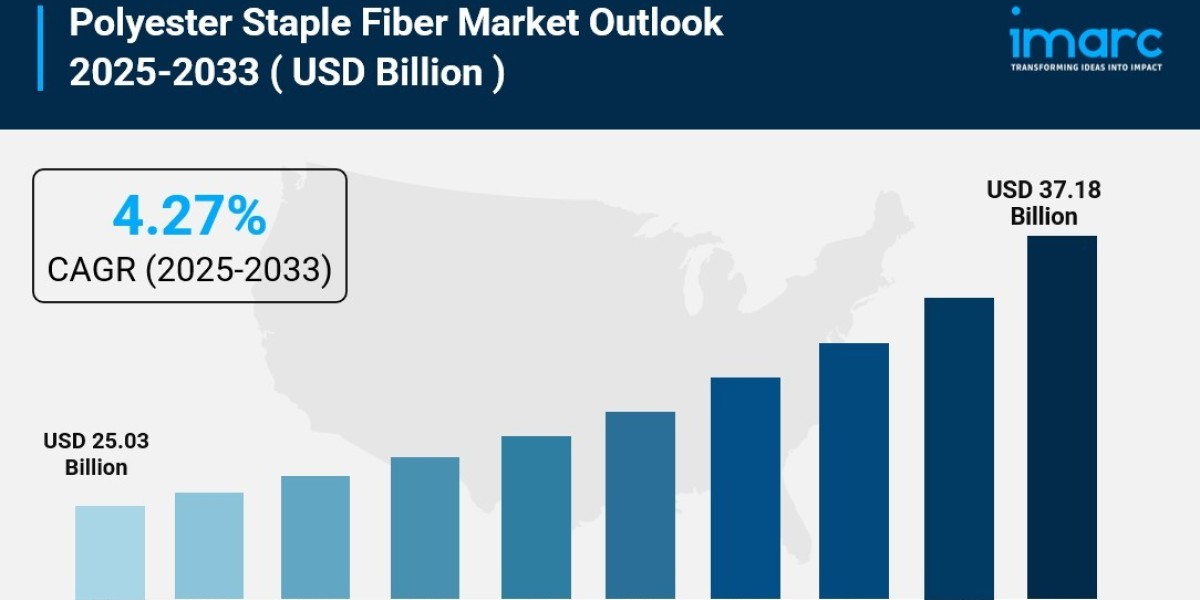

The global polyester staple fiber market size was valued at USD 25.03 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 37.18 Billion by 2033, exhibiting a CAGR of 4.27% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 77.6% in 2024. The market is experiencing steady growth driven by rising textile demand, particularly in fast-fashion and activewear, due to its affordability and durability, growth in non-woven applications such as automotive, construction, and hygiene products, urbanization and disposable income growth in emerging economies, and PSF's cost and performance advantages over natural fibers driving adoption.

Key Stats for Polyester Staple Fiber Market:

- Polyester Staple Fiber Market Value (2024): USD 25.03 Billion

- Polyester Staple Fiber Market Value (2033): USD 37.18 Billion

- Polyester Staple Fiber Market Forecast CAGR: 4.27%

- Leading Segment in Polyester Staple Fiber Market in 2024: Virgin (42.2%)

- Key Regions in Polyester Staple Fiber Market: Asia Pacific, Europe, North America, Latin America, Middle East and Africa

- Top companies in Polyester Staple Fiber Market: Alpek Polyester, Bombay Dyeing, Diyou Fibre (M) Sdn Bhd., Huvis Corp., Indorama Corporation, Reliance Industries Limited, Thai Polyester Co., Ltd, Toray Industries, Inc., Vnpolyfiber, William Barnet and Son, LLC, Xin Da Spinning Technology Sdn. Bhd., etc.

Why is the Polyester Staple Fiber Market Growing?

The polyester staple fiber market is experiencing robust growth as industries worldwide recognize its versatility, cost-effectiveness, and performance advantages that make it indispensable across multiple sectors. This isn't just about traditional textiles anymore – it's about sophisticated applications in automotive, construction, filtration, and emerging sustainable technologies that are reshaping the entire fiber landscape.

The fast fashion industry continues to be a massive growth driver, with the USD 185 billion sector fueling demand for affordable, durable synthetic fibers. Polyester accounts for over half of all fibers used in fast fashion, and despite growing environmental awareness, 73% of Generation Z consumers still opt for fast fashion due to financial constraints. Synthetic fibers, led by polyester, are expected to comprise 73% of all textiles by 2030, reflecting the material's dominant position in global fiber consumption.

Real estate expansion is creating unexpected opportunities for polyester staple fiber demand. India witnessed record institutional real estate investments reaching USD 8.9 billion across 78 deals in 2024 – a 51% increase compared to the previous year. This construction boom drives PSF consumption as it enhances concrete quality, fills cracks, and improves durability in walls, tanks, tiles, and blocks. Global urbanization trends are amplifying this effect across emerging markets.

The automotive industry represents a rapidly expanding application area. PSF is extensively used in manufacturing automotive textiles including roofs, airbags, trunk liners, carpet backing, glove boxes, door panels, safety belts, and sound insulation materials. In India alone, demand for light commercial vehicles is projected to reach 858.61 thousand units by 2025 and 970.05 thousand units by 2030, creating substantial opportunities for PSF manufacturers.

World production of virgin synthetic fibers rose dramatically from 67 million to 75 million tonnes in 2023, with low-cost polyester representing 57% of total fiber production. This growth reflects the material's continued dominance over natural fibers due to cost efficiency and performance benefits, particularly as cotton production faces challenges and price volatility.

Request Sample URL: https://www.imarcgroup.com/polyester-staple-fiber-market/requestsample

How AI is Reshaping the Future of Polyester Staple Fiber:

Artificial intelligence is transforming polyester staple fiber manufacturing from traditional chemical processing into smart, predictive, and highly optimized production systems that maximize efficiency while minimizing environmental impact. The integration of AI across the PSF value chain is revolutionizing quality control, sustainability, and operational performance.

Machine learning algorithms are optimizing polymerization processes in real-time, analyzing thousands of parameters including temperature, pressure, catalyst distribution, and molecular weight to produce consistent, high-quality fiber with minimal waste. AI systems can predict optimal spinning conditions, adjust fiber properties dynamically, and ensure uniform denier and strength characteristics across production batches. This precision manufacturing reduces material waste and energy consumption while improving product consistency.

Quality control has been revolutionized through computer vision and AI-powered inspection systems. Advanced algorithms can detect microscopic defects, inconsistencies in fiber diameter, and color variations that human inspectors might miss. These systems provide instant feedback to production teams, enabling immediate adjustments that prevent defective materials from entering the supply chain. Real-time quality monitoring ensures that PSF meets exact specifications for demanding applications in automotive, filtration, and technical textiles.

Predictive maintenance powered by AI is transforming operational efficiency across PSF manufacturing facilities. Smart sensors monitor equipment performance, analyzing vibration patterns, temperature fluctuations, and wear indicators to predict maintenance needs before breakdowns occur. This prevents costly production interruptions and extends equipment lifespan, while optimizing maintenance schedules to minimize operational disruption.

Supply chain optimization through AI is helping manufacturers balance raw material costs, production capacity, and market demand more effectively. Intelligent systems analyze global PET pricing, energy costs, transportation logistics, and demand forecasts to optimize procurement and production scheduling. This is particularly valuable given the volatility in petrochemical feedstock prices and the complexity of global textile supply chains.

Segmental Analysis:

Analysis by Origin:

- Virgin

- Recycled

- Blended

Virgin stands as the largest component in 2024, holding around 42.2% of the market due to its superior quality, consistency, and performance in high-end textile and industrial applications. Unlike recycled PSF, virgin fiber offers enhanced strength, uniformity, and dyeability, making it preferred for premium apparel, home textiles, and technical fabrics.

Analysis by Product:

- Solid

- Hollow

Solid leads the market with around 64.2% of market share in 2024, driven by its versatility and widespread use across multiple industries. Its uniform structure and consistent properties make it ideal for textiles, apparel, home furnishings, and industrial applications such as automotive upholstery and filtration.

Analysis by Application:

- Automotive

- Home Furnishing

- Apparel

- Filtration

- Others

Apparel leads the market with around 45.8% of market share in 2024, driven by its widespread use in affordable, durable, and versatile clothing. The fast-fashion industry heavily relies on PSF for its quick production cycles, cost efficiency, and ability to mimic natural fibers such as cotton.

Analysis of Polyester Staple Fiber Market by Regions

- Asia Pacific

- Europe

- North America

- Latin America

- Middle East and Africa

Asia-Pacific accounts for the largest market share of over 77.6% in 2024, driven by robust textile manufacturing, cost-competitive production, and strong domestic demand. Countries including China, India, and Vietnam lead consumption through expanding apparel industries, export-oriented garment production, and growing non-woven applications. The region benefits from well-established supply chains, low labor costs, and government support for synthetic fiber industries.

What are the Drivers, Restraints, and Key Trends of the Polyester Staple Fiber Market?

Market Drivers:

The polyester staple fiber market benefits from multiple powerful trends that span consumer behavior, industrial applications, and economic development across emerging markets. The textile and apparel industry remains the primary demand driver, with fast fashion's continued growth creating sustained need for affordable, versatile synthetic fibers that can be produced quickly and at scale.

Urbanization and rising disposable incomes in emerging economies are fueling textile consumption growth. As populations migrate to cities and household incomes increase, demand for clothing, home furnishings, and consumer goods rises proportionally. This demographic shift creates substantial market opportunities, particularly in Asia-Pacific markets where urbanization rates continue to accelerate.

Industrial applications are expanding rapidly beyond traditional textiles. The automotive industry's growth drives demand for technical textiles used in interiors, sound insulation, and safety components. Construction industry expansion increases demand for geotextiles, insulation materials, and reinforcing fibers. Filtration applications in water treatment, air purification, and industrial processes represent growing market segments with specific performance requirements.

Cost advantages over natural fibers continue to drive substitution trends. Cotton price volatility and supply constraints make PSF an attractive alternative for manufacturers seeking consistent pricing and reliable supply chains. Performance benefits including durability, moisture resistance, and processing efficiency further support adoption across multiple applications.

Market Restraints:

Despite strong growth drivers, the polyester staple fiber market faces significant challenges from environmental concerns and changing consumer preferences. Sustainability pressures are intensifying as consumers, brands, and regulators focus on plastic waste and microfiber pollution associated with synthetic textiles.

Recycling infrastructure limitations constrain the growth of sustainable PSF alternatives. While recycled polyester demand is growing, recycled PSF shares dropped to 12.5% due to cost pressures and inadequate recycling technology. This creates challenges for manufacturers seeking to meet sustainability targets while maintaining cost competitiveness.

Regulatory pressures continue to increase across major markets. Environmental regulations targeting plastic waste, chemical emissions, and textile waste are creating compliance costs and operational constraints. Trade policies, including protective measures like the U.S. Section 201 safeguard on fine denier PSF with zero-import quotas, can disrupt established supply chains and market dynamics.

Raw material price volatility affects profitability and planning. PSF production depends on petrochemical feedstocks whose prices fluctuate with oil markets, creating margin pressures and planning uncertainties for manufacturers and downstream users.

Market Key Trends:

The polyester staple fiber industry is experiencing transformative changes driven by sustainability initiatives, technological innovation, and evolving application requirements. Recycling and circular economy practices are gaining momentum, with manufacturers investing in advanced recycling technologies to convert post-consumer and post-industrial waste into high-quality PSF.

Innovation in fiber engineering has led to development of polyester with enhanced moisture-wicking, antimicrobial, and quick-drying properties. These advancements are particularly popular in activewear and outdoor gear, where performance and comfort are paramount. Technical innovations are expanding PSF applications into specialized industrial uses requiring specific performance characteristics.

Sustainability certifications and eco-friendly production processes are becoming competitive differentiators. Manufacturers are adopting cleaner production technologies, renewable energy sources, and closed-loop manufacturing processes to reduce environmental impact and meet customer sustainability requirements.

Vertical integration strategies are emerging as companies seek to control costs and quality across the value chain. Major manufacturers are investing in upstream petrochemical capabilities and downstream textile processing to capture additional value and ensure supply chain reliability.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=3869&flag=C

Leading Players of Polyester Staple Fiber Market:

According to IMARC Group's latest analysis, prominent companies shaping the global polyester staple fiber landscape include:

- Alpek Polyester

- Bombay Dyeing

- Diyou Fibre (M) Sdn Bhd.

- Huvis Corp.

- Indorama Corporation

- Reliance Industries Limited

- Thai Polyester Co., Ltd

- Toray Industries, Inc.

- Vnpolyfiber

- William Barnet and Son, LLC

- Xin Da Spinning Technology Sdn. Bhd.

These leading providers are expanding their footprint through capacity expansions, technological advancements, sustainability initiatives, and strategic collaborations to meet growing demand across textile, automotive, construction, and industrial applications while adapting to environmental regulations and changing consumer preferences.

Recent News and Developments in Polyester Staple Fiber Market:

- November 2024: The United States imposed a Section 201 safeguard on fine denier polyester staple fiber, setting a zero-import quota with 1 million pound increments annually for four years. This trade policy protects domestic PSF manufacturers while ensuring downstream industry needs are met, marking a fundamental shift in U.S. polyester trade strategy.

- August 2024: UNIFI launched REPREVE, an extensive performance polyester portfolio featuring black and white staple fiber and black filament yarn equipped with inherent tracer technology. This innovation demonstrates the industry's focus on developing traceable, high-performance recycled polyester solutions for premium applications.

- 2024: Americans spent approximately USD 420 billion on home remodeling, driving significant demand for polyester-based home furnishing products including carpets, curtains, and upholstery. This trend reflects growing consumer investment in interior aesthetics and modernization, creating substantial market opportunities for PSF manufacturers.

- 2021-2024: Brazil's PET packaging recycling rate reached 56.4% in 2021, marking a 15.4% increase compared to 2019. This improvement in recycling infrastructure supports the availability of recycled PET bottle flakes for sustainable PSF production, aligning with environmental goals and cost efficiency objectives across Latin America.

- 2024: Saudi Arabia's construction sector expansion includes over 5,200 projects underway valued at USD 819 billion. This massive construction boom across residential and commercial spaces drives demand for durable interior materials, creating significant opportunities for polyester staple fiber in carpets, upholstery, and wall fabrics.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249,

USA Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302