IMARC Group, a leading market research company, has recently releases a report titled “Revenue Cycle Management Market Size, Share, Trends and Forecast by Type, Component, Deployment, End User, and Region, 2025-2033.” The study provides a detailed analysis of the industry, including the global revenue cycle management market size, trends, share and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Revenue Cycle Management Market Highlights:

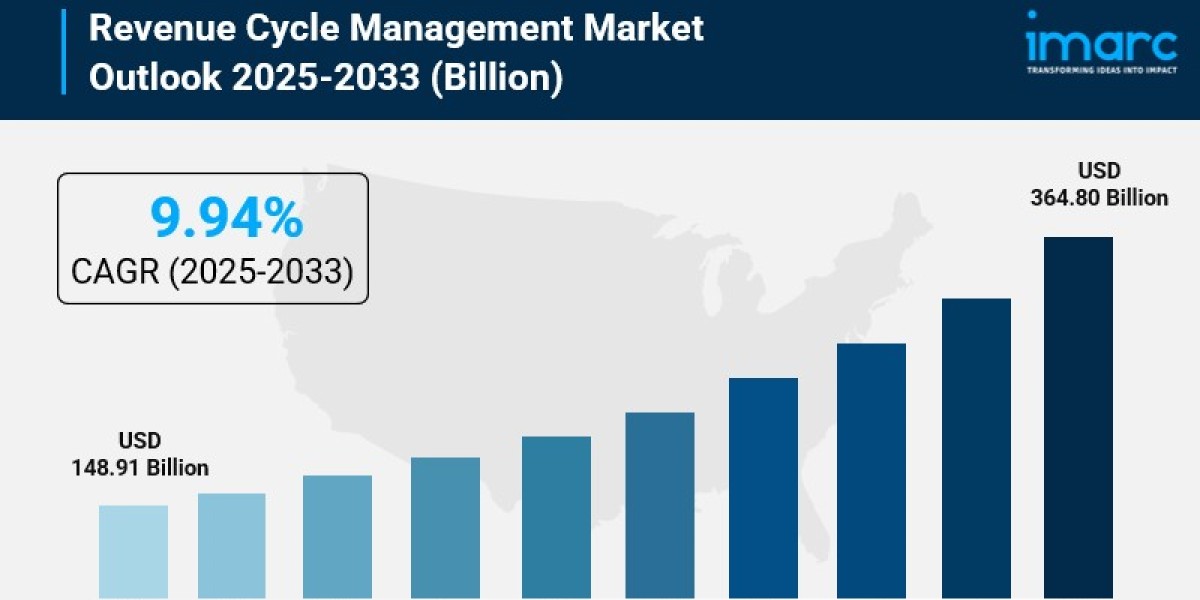

- Revenue Cycle Management Market Size: Valued at USD 148.91 billion in 2024.

- Revenue Cycle Management Market Forecast: The market is expected to reach USD 364.80 billion by 2033, growing at an impressive rate of 9.94% annually.

- Market Growth: The revenue cycle management market is experiencing robust growth driven by accelerating healthcare digitization and rising demand for operational efficiency.

- Technology Integration: Advanced technologies like AI-powered automation, machine learning analytics, and cloud-based platforms are revolutionizing healthcare billing and reimbursement processes.

- Regional Leadership: North America commands the largest market share at over 55.0%, fueled by sophisticated healthcare infrastructure and comprehensive technology adoption.

- Automation Revolution: Healthcare providers are increasingly leveraging AI solutions that can achieve 99.99% accuracy in data processing, transforming traditional revenue cycle operations.

- Key Players: Industry leaders include Allscripts Healthcare LLC, Athenahealth, CareCloud Inc., Cerner Corporation, and Cognizant, which dominate the market with cutting-edge solutions.

- Market Challenges: High implementation costs for smaller healthcare organizations and shortage of trained professionals present ongoing challenges to market expansion.

Request for a sample copy of the report: https://www.imarcgroup.com/revenue-cycle-management-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Explosive Growth in Healthcare Digitization:

Healthcare organizations worldwide are embracing digital transformation at an unprecedented pace, and now deploy electronic health records within more than 90% of office-based practices and hospitals across the United States. In 2025, center stage is something that will be taken. AI solutions are going to be there. Agents using AI completely automate most RCM processes. Automation for these processes is nearly complete. This digital shift is now creating enormous opportunities for revenue cycle management for providers. Healthcare facilities seek to streamline financial operations for creating this opportunity. Telehealth services both integrated and thereby accelerated this trend; industry reports indicate that about 54% of Americans had such visits, and around 89% expressed their satisfaction.

- Revolutionary AI and Automation Integration:

Artificial intelligence is rapidly adopted by healthcare providers so their revenue operations transform. Deploying automation as well as analytics effectively alone could eliminate from $200 billion to $360 billion of US healthcare spending, research suggests. Really huge amounts of unstructured healthcare data are truly now processed with fully outstanding precision by such AI-powered systems. As an instance, Maverick Medical AI joined RadNet, Inc. during November 2023 to add self-governing medical coding platforms showing AI optimizing revenue cycles, cutting operational costs, plus increasing reimbursements. Autonomous coding will likely prevail to support medical coding teams also reduce coding costs plus help improve payment cycles throughout 2025.

- Massive Healthcare Infrastructure Investment:

Healthcare sees investment for infrastructure that is now more modern. In 2022, the United States spent nearly USD 4.4 trillion on healthcare because it represented a 4.1% increase from the previous year. Advanced revenue cycle management solutions are in demand since healthcare expenditure is surging. More than 68% of hospitals with more than 150 beds outsourced RCM services during 2020 since it is now recognized that some specialized expertise is often needed in order to manage more complex billing processes. As of March in 2023, countries such as India have established thorough healthcare networks that include 6,359 community health centers with 31,882 primary health centers. Due to all of this, good opportunities for RCM providers have arisen now.

- Enhanced Security and Regulatory Compliance Demands:

Healthcare organizations face security challenges with increasingly complex regulatory requirements. Value-based care models shift so they demand revenue cycle management with sophistication for compliance as you optimize reimbursements. India's Ayushman Bharat program along with similar government initiatives are introducing complex reimbursement mechanisms. Therefore, these initiatives do require strong RCM systems in order to support the mechanisms. Advanced RCM solutions fostering adoption can navigate around variations in reimbursement policies while maintaining financial stability due to the increasing emphasis on patient-centric care and billing transparency.

Revenue Cycle Management Market Report Segmentation:

Breakup by Type:

- Standalone

- Integrated

Integrated systems dominate with 73.7% market share, preferred for their ability to connect different aspects of healthcare operations from clinical to administrative functions.

Breakup by Component:

- Software

- Services

Software leads the market, driven by growing adoption of specialized solutions that enhance efficiency and accuracy in billing and revenue management.

Breakup by Deployment:

- Web-Based

- Cloud-Based

- On-Premises

Web-based solutions command 53.8% market share, offering improved accessibility across multiple locations and devices for enhanced operational flexibility.

Breakup by End User:

- Hospitals

- Physicians

- Diagnostic and Ambulatory Care Centers

Hospitals represent the largest end-user segment due to their complex billing systems, diverse patient base, and wide range of medical services requiring sophisticated RCM solutions.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Who are the key players operating in the industry?

The report covers the major market players including:

- Athenahealth

- CareCloud, Inc.

- Cognizant

- eClinicalWorks

- Epic Systems Corporation

- Experian Information Solutions, Inc.

- GE HealthCare

- GeBBS Healthcare Solutions

- McKesson Medical-Surgical Inc.

- NXGN Management, LLC

- Oracle Corporation

- Veradigm LLC

Ask Analyst & Browse full report with TOC List of Figures: https://www.imarcgroup.com/request?type=report&id=5647&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302