IMARC Group, a leading market research company, has recently released a report titled “Trade Finance Market Size, Share, Trends and Forecast by Finance Type, Offering, Service Provider, End-User, and Region, 2025-2033”. The study provides a detailed analysis of the industry, including the trade finance market trends, growth, size, and industry growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights:

How Big Is the global trade finance market?

The global trade finance market size was valued at USD 54.12 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 84.31 Billion by 2033, exhibiting a CAGR of 5.70% during 2025-2033. North America currently dominates the market.

The trade finance market in 2025 is easing international trade by playing a major role in improving liquidity as well as reducing risks with financial solutions for businesses. Trade finance works to help importers and also exporters manage cross-border transactions in a more efficient way because it includes such services as letters of credit with guarantees plus export credit as well as supply chain financing.

This market grows, global trade expands, supply chains recover, and e-commerce grows. Trade finance is also used by small and medium-sized enterprises to get working capital and compete internationally.

Digital technologies are being integrated within trade finance processes which is a major trend. For 2025, this integration will stand as a key development. Blockchain, artificial intelligence, and digital platforms are being adopted for improved transparency, for sped-up documentation, and for fraud reduction. Trade finance is in the process of becoming more accessible and more cost-effective because of all of these innovations. It is helping businesses both large and small.

Government initiatives and regulatory support are shaping the market. Sustainable financing does also contribute to all of this shaping. Because businesses increasingly seek green financing options, trade finance providers focus on solutions aligning with ESG goals. Therefore, the trade finance market is expected for growth in 2025. This growth here should be quite steady.

Get your Sample of Trade Finance Market Insights for Free: https://www.imarcgroup.com/trade-finance-market/requestsample

Trade Finance Market Segmentation:

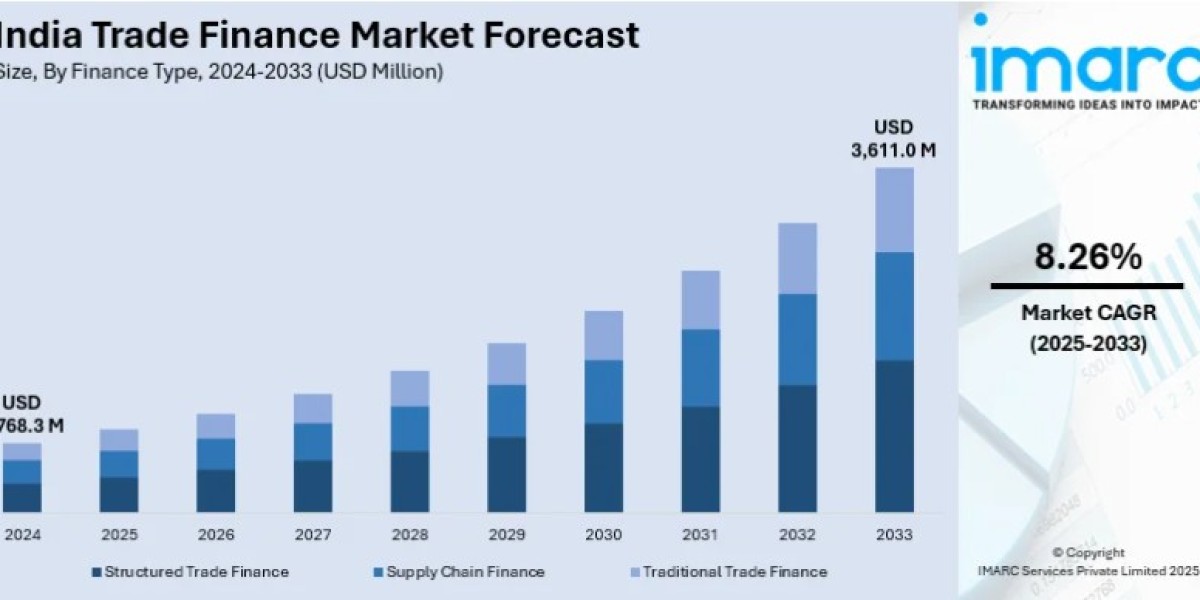

Segmentation by Finance Type:

- Structured Trade Finance

- Supply Chain Finance

- Traditional Trade Finance

Segmentation by Offering:

- Letters of Credit

- Bill of Lading

- Export Factoring

- Insurance

- Others

Segmentation by Service Provider:

- Banks

- Trade Finance Houses

Segmentation by End-User:

- Small and Medium Sized Enterprises (SMEs)

- Large Enterprises

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

Who are the key players operating in the industry?

The report covers the major market players including:

- Asian Development Bank

- Banco Santander SA

- Bank of America Corp.

- BNP Paribas SA

- Citigroup Inc.

- Crédit Agricole Group

- Euler Hermes

- Goldman Sachs Group Inc.

- HSBC Holdings Plc

- JPMorgan Chase & Co.

- Mitsubishi Ufj Financial Group Inc.

- Morgan Stanley

- Royal Bank of Scotland

- Standard Chartered Bank

- Wells Fargo & Co.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=2031&flag=E

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302