Introduction

The global tire recycling market is undergoing a transformative phase, driven by growing environmental awareness, regulatory mandates, and technological innovations. With billions of tires discarded annually, the challenge of managing end-of-life tires (ELTs) has prompted governments, industries, and environmental bodies to push for sustainable recycling solutions. The result is a dynamic market with increasing investments and innovations across regions.

Market Overview

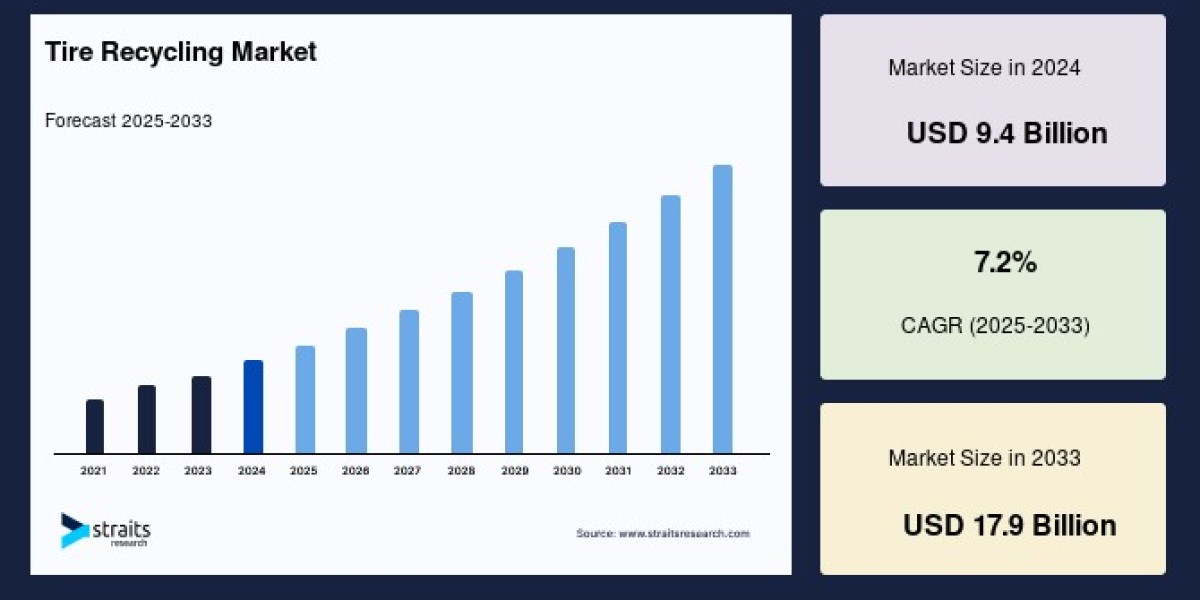

The global tire recycling market was valued at USD 9.4 billion in 2024 and is projected to grow from USD 10.1 billion in 2025 to USD 17.9 billion in 2033, exhibiting a CAGR of 7.2% during the forecast period (2025–2033).

Key Market Drivers

1. Environmental Regulations and Sustainability Goals

Governments worldwide are enforcing stringent regulations to curb pollution and promote circular economy principles. Laws banning tire landfilling and incineration, especially in regions like Europe and North America, are pushing manufacturers and recyclers to adopt eco-friendly tire disposal and recycling practices.

2. Extended Producer Responsibility (EPR)

EPR policies are compelling tire manufacturers and importers to take responsibility for the lifecycle of their products, including post-consumer waste management. These policies have incentivized the development of efficient recycling systems and encouraged partnerships between governments and private companies.

3. Technological Innovation

Advancements in tire recycling technologies such as pyrolysis, devulcanization, and chemical recycling have significantly enhanced the quality and quantity of recoverable materials. These innovations have broadened the scope of applications for recycled tire products in industries like construction, automotive, and energy.

4. Economic Benefits

Recycled tire products like crumb rubber, reclaimed steel, pyrolysis oil, and carbon black are cost-effective alternatives to virgin materials. Their use in road construction, molded products, playgrounds, and industrial fuel has made recycling a financially viable solution.

Market Segmentation

By Component

Solutions: End-to-end systems that include sorting, processing, and reuse.

Services: Collection, transportation, and compliance services tailored for municipalities and enterprises.

By the Recycling Process

Mechanical Shredding: The most common method, involving physical size reduction.

Pyrolysis: Thermochemical decomposition to produce oil, gas, and char.

Devulcanization: Breaks sulfur bonds in rubber for reuse in new tires.

Chemical Recycling: Converts rubber into its original monomers or other chemical feedstocks.

Others: Includes ambient grinding and cryogenic processing.

By Application

Construction: Use in road surfaces, rubberized asphalt, and insulation materials.

Automotive: Recycled rubber for floor mats, bumpers, and soundproofing.

Manufacturing: Raw material for conveyor belts, gaskets, and industrial flooring.

Energy: Pyrolysis oil and tire-derived fuel (TDF) for power generation.

Others: Landscaping, footwear, and sports surfaces.

By Region

North America: Largest market with well-established recycling infrastructure and strict environmental laws.

Europe: Advanced in regulatory support and sustainable road construction using rubber asphalt.

Asia-Pacific: Fastest-growing region due to rising vehicle ownership and infrastructure investments.

Middle East & Africa: Growing interest in waste-to-energy projects using tires.

Latin America: Gradual development driven by urbanization and environmental policies.

Competitive Landscape

The market is moderately consolidated, with a mix of global giants and regional players. Companies are investing heavily in R&D to develop cleaner and more efficient recycling methods. Strategic collaborations, mergers, and capacity expansions are common as firms race to capture market share and meet regulatory standards.

Key Players Include:

Liberty Tire Recycling

Genan Holding A/S

Michelin Group

Bridgestone Corporation

Continental AG

Goodyear Tire & Rubber Company

Apollo Tyres Ltd.

Shandong Linglong Tire

Hankook Tire

Lehigh Technologies

Scandinavian Enviro Systems

Green Distillation Technologies

Recent Industry Developments

Devulcanization Breakthroughs: Leading chemical companies have developed methods that allow rubber from used tires to be reused in new tire production without compromising quality.

Pyrolysis Expansion: Facilities in Europe and Asia are ramping up pyrolysis capacity to meet demand for sustainable carbon black and fuel substitutes.

Smart Recycling Systems: Integration of AI and IoT in sorting and quality control systems is improving operational efficiency and product consistency.

Opportunities and Challenges

Opportunities

Government incentives for sustainable infrastructure.

Increasing demand for eco-friendly products in automotive and construction.

Rising public and corporate commitment to net-zero emissions and ESG goals.

Challenges

High initial capital investment for recycling plants.

Lack of standardization in product quality from recycled materials.

Limited awareness and infrastructure in developing regions.

Future Outlook

The tire recycling industry is poised for sustained growth, supported by regulatory momentum, increasing tire waste volumes, and rapid innovation in recycling technologies. As sustainability becomes a core strategic goal for businesses and governments, tire recycling will play a crucial role in achieving environmental targets and creating a closed-loop economy.

Conclusion

The global tire recycling market presents a compelling intersection of environmental responsibility and economic opportunity. With regulations tightening and technologies advancing, the industry is entering a new era of scalability and efficiency. Stakeholders who invest in innovative processes and sustainable practices now will be well-positioned to lead the market in the decade ahead.