Introduction

Food preservation has been a critical component of the global food industry for centuries. In today’s rapidly evolving food landscape where consumer demand for freshness, safety, and convenience is higher than ever the role of food preservatives has become even more significant. These substances extend the shelf life of food products by inhibiting microbial growth, oxidation, and spoilage. As global food supply chains grow increasingly complex, the importance of effective food preservation is paramount.

The global food preservatives market is experiencing steady growth due to rising processed food consumption, increasing global population, urbanization, and heightened awareness about food safety. The industry is undergoing a notable transformation as synthetic additives make way for natural, clean-label alternatives, reshaping the competitive landscape and regulatory frameworks across major regions.

Market Overview

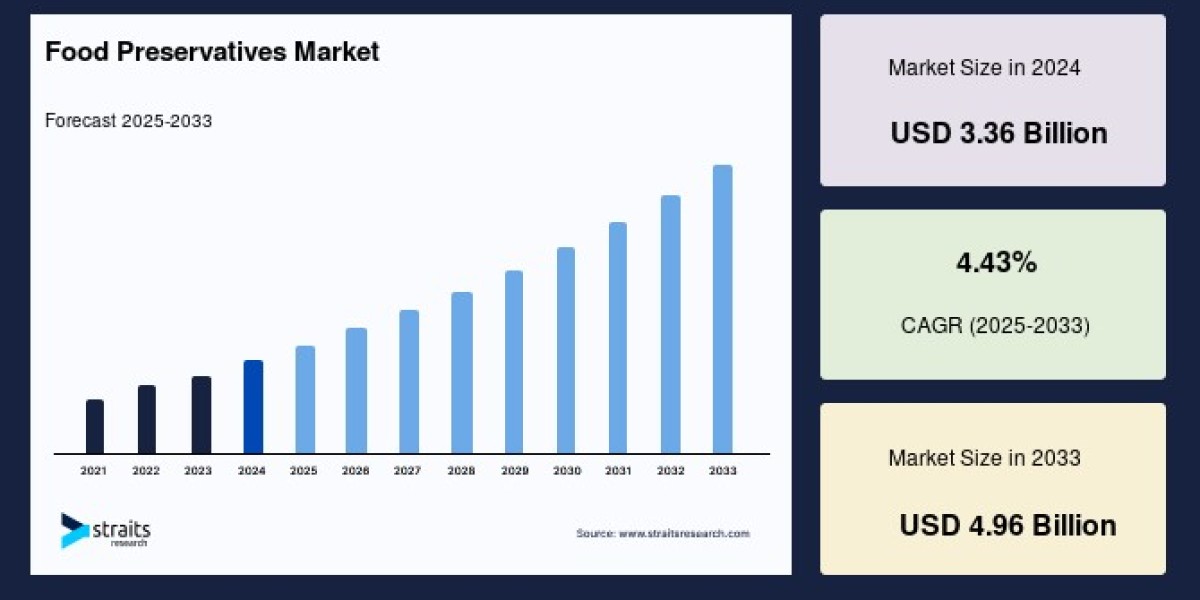

As of 2024, the global food preservatives market is valued at approximately USD 3.36 billion. The market is projected to grow to USD 3.5 billion in 2025, and further to USD 4.96 billion by 2033, expanding at a compound annual growth rate (CAGR) of 4.43% during the forecast period of 2025–2033.

The consistent demand for processed and packaged food, the rise of e-commerce grocery platforms, and increasing concerns over food wastage are acting as key accelerators of growth in this space.

Key Market Drivers

1. Rising Demand for Processed and Packaged Food

Globally, changing lifestyles and busy work routines are fueling demand for ready-to-eat, frozen, and convenience foods. These products often have longer supply chains and require effective preservation solutions to maintain safety, taste, and nutritional value over time.

2. Increased Focus on Food Safety and Shelf Life

Preservatives play a crucial role in extending the usability of food products and preventing spoilage, mold, and microbial contamination. As consumers and regulators become more vigilant about foodborne illnesses and spoilage, the demand for reliable preservatives continues to grow.

3. Growth of the Clean-Label Movement

Consumers are now more conscious than ever of the ingredients in their food. There's a strong demand for natural, recognizable substances over synthetic chemicals. This shift is compelling food manufacturers to move toward "clean-label" preservatives such as vinegar, citrus extracts, rosemary, and fermented-based ingredients.

4. Stringent Global Food Regulations

Regulatory bodies around the world are increasingly imposing limits on the use of artificial and synthetic additives. These restrictions are pushing manufacturers to seek safer, more natural alternatives and invest in research and development to remain compliant and competitive.

Market Segmentation

By Label Type

Clean Label Preservatives

Rising significantly in demand as consumers prefer fewer, natural ingredients on product labels. These are derived from plants, fermented products, and other natural sources.Conventional/Synthetic Preservatives

Although effective and widely used due to cost efficiency and availability, synthetic preservatives face declining consumer trust and regulatory pressure.

By Type

Natural Preservatives: Include salt, sugar, vinegar, alcohol, citric acid, and plant-based extracts. These are gaining popularity for their perceived safety and environmental friendliness.

Synthetic Preservatives: Includes benzoates, nitrites, sulfites, and sorbates. While effective and economical, their usage is declining in regions with strong clean-label movements.

By Function

Antimicrobial Agents: Prevent bacterial and fungal growth, widely used across meat, dairy, and baked goods.

Antioxidants: Delay rancidity and oxidation in fats and oils, improving shelf life of products like snacks and ready meals.

Enzyme Inhibitors: Prevent spoilage by slowing enzymatic processes.

By Application

Meat and Poultry Products: Require strong antimicrobial solutions due to high perishability.

Bakery & Confectionery: Use preservatives to prevent mold growth and maintain texture.

Dairy and Frozen Foods: Require both antimicrobial and antioxidant preservatives.

Beverages: Utilize preservatives to extend shelf life without refrigeration.

Snacks and Savory Foods: Often use a combination of natural and synthetic preservatives.

Regional Analysis

North America

Holds the largest share of the global market.

Strong presence of major food processing companies.

Consumer demand for clean-label foods is high.

Regulatory environment is strict, especially regarding synthetic preservatives.

Europe

Fastest-growing regional market.

Stringent EU regulations limit the use of synthetic additives.

Rising vegan and organic food sectors are encouraging innovation in natural preservatives.

Asia-Pacific

Witnessing rapid growth due to urbanization, population growth, and expanding middle-class demographics.

High demand for packaged foods in countries like China, India, and Southeast Asia.

Increasing regulatory scrutiny is influencing local manufacturers to adopt global best practices.

Latin America and Middle East & Africa

Moderate growth but with rising awareness about food safety and preservation.

Government initiatives supporting food processing and agriculture modernization.

Competitive Landscape

The global food preservatives market is moderately consolidated, with several multinational corporations and regional players competing in both synthetic and natural segments. Key players are focusing on clean-label product development, strategic mergers, capacity expansion, and geographic diversification.

Major Companies Operating in the Market

Kemin Industries

Cargill Inc.

Archer Daniels Midland Company (ADM)

BASF SE

Tate & Lyle

Corbion N.V.

Galactic S.A.

Dow Chemical Company

Univar Solutions

Celanese Corporation

Recent Industry Developments

New Product Launches: Companies are introducing blends of natural preservatives to meet the dual goals of shelf life extension and clean-label compliance.

Regulatory Changes: Countries like Hong Kong and several in the EU have updated food safety regulations, encouraging innovation in plant-derived preservatives.

Sustainability Initiatives: Companies are investing in sustainable sourcing and environmentally friendly preservation solutions.

Tech Integration: Innovations such as active packaging, micro-encapsulation, and AI-driven shelf-life prediction models are entering the market to complement chemical preservatives.

Challenges

Regulatory Uncertainty: Constantly changing food safety standards pose a compliance challenge for manufacturers.

Consumer Skepticism: Even natural preservatives are sometimes misunderstood or mistrusted.

Cost Pressures: Natural preservatives are often more expensive than synthetic alternatives, posing a challenge for cost-sensitive markets.

Technical Limitations: Natural preservatives may not offer the same shelf life or spectrum of activity as synthetic ones, leading to product development challenges.

Future Outlook

The food preservatives market is on a resilient growth path, backed by demographic trends, technological advancements, and evolving consumer behavior. While synthetic preservatives will continue to play a role, the future is clearly shifting toward natural, transparent, and multifunctional preservation strategies.

Food companies that can effectively balance safety, sustainability, affordability, and consumer trust will emerge as leaders in this next chapter of the global food system.