Introduction

The global meat pads market is witnessing robust growth driven by the rising demand for hygienic, sustainable, and efficient packaging solutions in the meat industry. Meat pads, which are absorbent materials placed under packaged meat, play a critical role in maintaining product quality by absorbing excess fluids, controlling odors, and extending shelf life. As consumers become more conscious about food safety and environmental impact, the meat pads market is evolving rapidly, offering innovative and eco-friendly solutions to meet these needs.

Market Overview

Meat pads are indispensable in the packaging of fresh meat, poultry, seafood, and processed meat products. Their primary function is to absorb exudate (liquid released from the meat), thus preventing leakage, maintaining hygiene, and enhancing the product’s visual appeal. This directly influences consumer purchasing decisions and reduces food waste caused by spoilage.

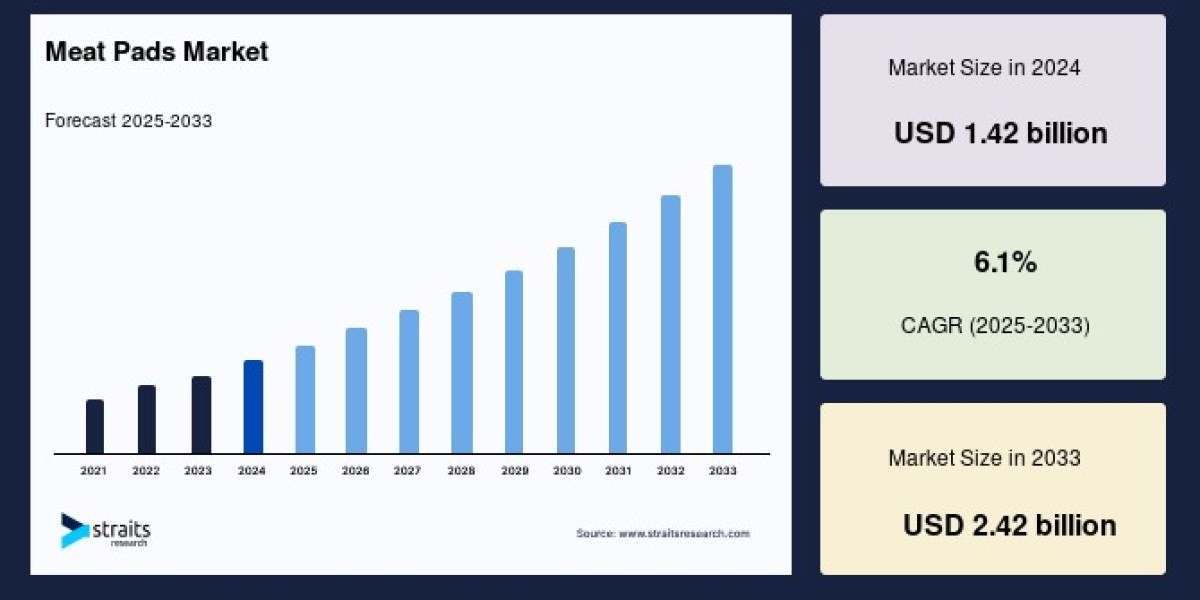

The global meat pads market size was valued at USD 1.42 billion in 2024 and is projected to grow from USD 1.51 billion in 2025 to USD 2.42 billion by 2033, expanding at a CAGR of 6.1% during the forecast period (2025-2033). This growth reflects increasing meat consumption worldwide, rapid urbanization, expansion of retail chains, and the demand for packaged meat products with longer shelf life.

Key Market Drivers

1. Increasing Demand for Hygienic Packaging

Food safety and hygiene have become paramount for consumers and regulatory bodies alike. Meat pads help reduce contamination risks by absorbing fluids that could otherwise become a breeding ground for bacteria. This ability to improve freshness and safety is driving their widespread adoption in supermarkets, butcher shops, and meat processing plants globally.

2. Growth in Meat Consumption

Global meat consumption has been rising steadily due to population growth, increasing disposable incomes, and changing dietary patterns, especially in developing economies. As meat consumption grows, so does the need for safe and effective packaging solutions, boosting demand for meat pads.

3. Extension of Shelf Life

By absorbing moisture and preventing fluid accumulation, meat pads help extend the shelf life of packaged meat products. This reduces spoilage, food waste, and economic losses for retailers and consumers alike, making meat pads an attractive investment for the supply chain.

4. Rising Focus on Sustainability

With growing awareness about environmental sustainability, the meat pads market is seeing a shift toward biodegradable, compostable, and recyclable materials. Manufacturers are innovating to produce eco-friendly pads made from cellulose, biopolymers, and other sustainable substances that align with circular economy goals and regulatory standards.

Market Segmentation

The meat pads market is broadly segmented based on product type, application, material, and end-user industries.

By Product Type

Non-Woven Absorbent Pads: The most widely used type due to high fluid absorption, durability, and cost-effectiveness.

Biodegradable & Compostable Pads: Gaining traction as environmentally friendly alternatives, these pads degrade naturally, reducing landfill waste.

Antimicrobial Pads: Embedded with antimicrobial agents to inhibit bacterial growth, improving safety and extending freshness.

Odor-Control Pads: Designed to absorb or neutralize unpleasant odors from meat exudate.

Superabsorbent Polymer (SAP) Pads: Contain polymers that can absorb and retain large volumes of fluid, enhancing performance in high-moisture applications.

Tray-Integrated Pads: Innovative designs where absorbent materials are integrated into the tray itself, eliminating the need for separate pads.

By Application

Fresh Red Meat Packaging: Includes beef, lamb, and pork, which require high absorption capacity due to their moisture content.

Poultry Packaging: Chicken and turkey meat pads designed for lighter fluids but larger volume packaging.

Seafood & Fish Packaging: Specialized pads tailored to absorb brine and water released by fresh or frozen seafood.

Processed & Sliced Meat Packaging: Pads used in ready-to-eat or deli meat products to maintain appearance and hygiene.

Ready-to-Cook Meat Products: Absorbent pads designed for marinated or pre-prepared meat portions.

By Material Type

Cellulose-Based Pads: Made from natural fibers, these pads are highly absorbent and biodegradable.

Airlaid Paper Pads: Produced from wood pulp, offering softness and efficient absorption.

Polyethylene (PE)-Coated Pads: Feature a water-resistant backing to prevent leakage onto packaging surfaces.

Biopolymer Pads (PLA, PHA): Made from plant-based polymers, these pads support sustainable packaging trends.

Activated Carbon-Infused Pads: Designed to adsorb odors and volatile organic compounds from meat exudate.

Regional Insights

Asia-Pacific

Asia-Pacific is emerging as the fastest-growing market, driven by increasing meat consumption, expanding retail infrastructure, and rising urban populations in countries such as China, India, Japan, and Southeast Asia. Innovations in packaging and growing awareness of food safety are also spurring demand for advanced meat pads.

North America

The North American market is mature and driven by stringent food safety regulations and strong consumer preference for hygienic packaging. The presence of major retail chains and foodservice companies ensures steady demand, with sustainability trends pushing adoption of biodegradable pads.

Europe

Europe is characterized by high consumer awareness regarding sustainability and health. Regulations promoting eco-friendly packaging and waste reduction fuel growth in the biodegradable and compostable meat pads segment.

Latin America, Middle East & Africa

These regions are poised for growth due to improvements in cold chain logistics, increasing processed meat consumption, and investments in food retail infrastructure.

Recent Trends and Innovations

Sustainable Materials: Manufacturers are developing pads with 100% biodegradable components that meet industrial composting standards, reducing environmental impact.

Antimicrobial and Odor-Control Technologies: Integration of antimicrobial agents and activated carbon layers enhances product safety and consumer appeal.

Customized Solutions: Tailored absorbency levels and sizes are being designed for specific meat types and packaging formats.

Supply Chain Integration: Direct supply arrangements with meat processors and retailers improve efficiency and reduce costs.

Challenges

Regulatory Compliance: Adhering to food contact safety regulations requires stringent testing and certification, posing a barrier for new entrants.

Price Sensitivity: Meat processors often face pressure to reduce packaging costs, which may limit adoption of premium meat pad products.

Raw Material Availability: The supply of biodegradable raw materials can be inconsistent, impacting production schedules.

Future Outlook

The global meat pads market is poised for sustained growth over the next decade. Factors such as rising meat consumption, urbanization, evolving consumer preferences for hygiene and sustainability, and innovations in materials and technology will drive this expansion.

Investment in research and development to create multifunctional, eco-friendly meat pads will be critical to capturing new market opportunities. Additionally, the adoption of intelligent packaging solutions combining absorbency with freshness indicators and antimicrobial properties could revolutionize the segment.