UAE Health Insurance Market Projected to Expand at 6.5% CAGR Through 2030

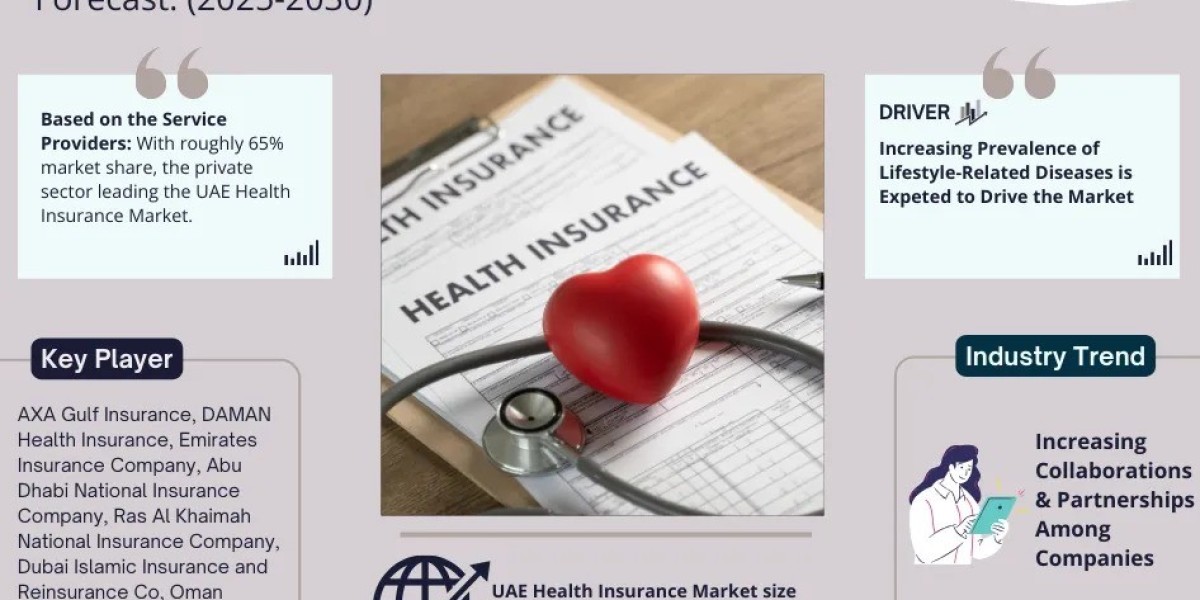

The UAE Health Insurance Market size was valued at around USD 8.7 billion in 2024 and is projected to reach USD 12.7 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 6.5% during the forecast period, i.e., 2025-30. Rapid expansion afflicts the market for health insurance in the UAE mostly due to shifting consumer demands, new technology adoption, and government regulations. The increasing demand for private health insurance is fueled by the country's growing population of expatriates who account for close to 88% of its total population.

Our Latest Reports Now Include In-Depth Supply Chain Ecosystem Analysis, Enabling Businesses to Navigate Tariff Challenges with Greater Agility Get Sample Report - https://www.marknteladvisors.com/query/request-sample/uae-health-insurance-market.html

Strategic Takeaways from the Report:

- Market Sizing and Forecasting

- Regulatory and Policy Influence

- Competitive Trends and M&A Activity

- Innovation Drivers and Disruptive Technologies

- Investment Hotspots and Emerging Niches

- Geographical Dynamics and Trade Flows

UAE Health Insurance Market Segment Overview & Classification

This market is categorized to offer targeted insights across various operational and consumer-related verticals.

Segment List:

By Product Type

- Individual- Market Size & Forecast 2020-2030, USD Million

- Group - Market Size & Forecast 2020-2030, USD Million

About 70% market share is held by the group segment that dominates the UAE Health Insurance Market. The country’s sizable expat population and the obligatory health insurance plans for workers and their dependents which are in place in Dubai and Abu Dhabi are the main causes of this dominance. Group insurance plans are becoming increasingly popular because employers are being forced to offer full health coverage. The ability to modify policies to organizational requirements also contributes to the segment's growth & expansion. Further supporting the group's segment dominance in the UAE health insurance market is the growing number of corporate wellness initiatives and business-insurance partnerships that incorporate value-added services like fitness memberships and mental health benefits.

By Service Providers

- Public- Market Size & Forecast 2020-2030, USD Million

- Private- Market Size & Forecast 2020-2030, USD Million

With roughly 65% market share, the private sector leading the UAE Health Insurance Market. As expatriates make up almost 88% of the UAE population, so there is a significant need for comprehensive and specialized healthcare services. Customized plans like maternity, dental, and chronic illness coverage are frequently lacking in public insurance programs but private insurers meet the various needs of foreign nationals. Its affiliations with upscale clinics and hospitals which give policyholders access to cutting-edge medical technology and reduced wait times further contribute to the private sector's prominence. The expansion of private insurance companies has been stimulated by the implementation of mandatory health insurance laws such as the Dubai Health Insurance Law. Furthermore, employers and individuals are choosing private health insurance solidifying its market dominance.

By Distribution Channel

- Agent - Market Size & Forecast 2020-2030, USD Million

- Banks - Market Size & Forecast 2020-2030, USD Million

- Online - Market Size & Forecast 2020-2030, USD Million

- Others - Market Size & Forecast 2020-2030, USD Million

By Region

- Dubai

- Abu Dhabi

- Sharjah

- Northern Emirates.

These divisions help clarify demand patterns and expected shifts.

Market Driver

Increasing Prevalence of Lifestyle-Related Diseases – The steady increase in the prevalence of lifestyle diseases such as; diabetes, hypertension, and other cardiovascular diseases, is one of the key factors supporting the UAE Health Insurance Market. The UAE has a high prevalence of diabetes, with more than 1 million people living with it. Additionally, unhealthy eating habits, stress, physical inactivity, and poor lifestyle choices constitute the major causes of hypertension, which affects roughly 30% of adults. The continuous and costly medical care that many chronic conditions require has pressed residents to look for comprehensive health insurance covering such procedures as expensive therapies, drugs, and routine checkups. Chronic diseases account for approximately 60% of healthcare, insurers offer custom-designed policies to provide unique needs that propel further market development considering the burden in the United Arab Emirates.

UAE Health Insurance Market Competitive Snapshot from 2025-2030

The report highlights established and emerging players in the global UAE Health Insurance Market, evaluating their strengths, challenges, and potential for innovation.

Key Competitors Include:

- AXA Gulf Insurance

- DAMAN Health Insurance

- Emirates Insurance Company

- Abu Dhabi National Insurance Company

- Ras Al Khaimah National Insurance Company

- Dubai Islamic Insurance and Reinsurance Co.

- Oman Insurance Company

- Alliance Insurance

- Orient Insurance

- Islamic Arab Insurance Company

- Al Ain Al Ahilia Insurance Company

- Al Buhaira National Insurance Company

Their activities include partnerships, product launches, and geographic expansions.

UAE Health Insurance Industry Prime Challenge

Increasing Instances of Insurance Fraud Affecting Industry's Integrity – One of the major obstacles for the health insurance market in the UAE is the increase in fraudulent insurance claims, which have led to the market's low integrity. Fraudulent in both public and private hospitals include making bills where no service was ever provided, faking the patient data, and inflating the medical bills. At these hospitals, the country's bigger dimension of the public and private health insurers is found encountering a massive financial burden due to those frauds. In the year 2021, healthcare fraud will cost the country between 5 to 10% of the total healthcare budget, leaving a figure going into billions of dirhams every year. It is an added burden on the already stretched healthcare systems because profiles for honest policyholders have to be increased, and profitability in insurers is reduced.

Frequently Asked Questions (FAQs):

- What industries are most impacted by this market?

- How is technology reshaping operations and offerings?

- Which competitors dominate the landscape?

- What risks could disrupt market expansion?

- How should businesses respond to demand fluctuations?

“Report Delivery Format: Market research reports from MarkNtel Advisors are available in PDF, Excel, and PowerPoint formats. Once payment is successfully processed, the report will be delivered to your email address within 24 hours”

Report Report:

- https://pando.life/article/1159000

- https://pando.life/article/1158964

- https://pando.life/article/1158952

- https://pando.life/article/1150551

- https://pando.life/article/1088198

Note: If you need additional information not included in the report, we can customize it to suit your requirements. https://www.marknteladvisors.com/query/request-customization/uae-health-insurance-market.html

Why Trust MarkNtel Advisors?

- In-depth primary and secondary data validation

- Focused on practical insights, not just raw numbers

- Designed to support business strategy, not just reporting

- Strong industry connections and real-time data flow

- Transparent methodology and reliable sourcing

About Us –

We are a leading market research company, consulting, & data analytics firm that provides an extensive range of strategic reports on diverse industry verticals. We deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, & individuals, among others.

Our specialization in niche industries & emerging geographies allows our clients to formulate their strategies in a much more informed way and entail parameters like Go-to-Market (GTM), product development, feasibility analysis, project scoping, market segmentation, competitive benchmarking, market sizing & forecasting, & trend analysis, among others, for 15 diverse industrial verticals.

Contact Us –

Email: sales@marknteladvisors.com

Sales Office: 564 Prospect St, B9, New Haven, Connecticut, USA-06511

Address Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India