IMARC Group has recently released a new research study titled “Mexico Calcium Chloride Market Size, Share, Trends and Forecast by Product Type, Application, Raw Material, Grade, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

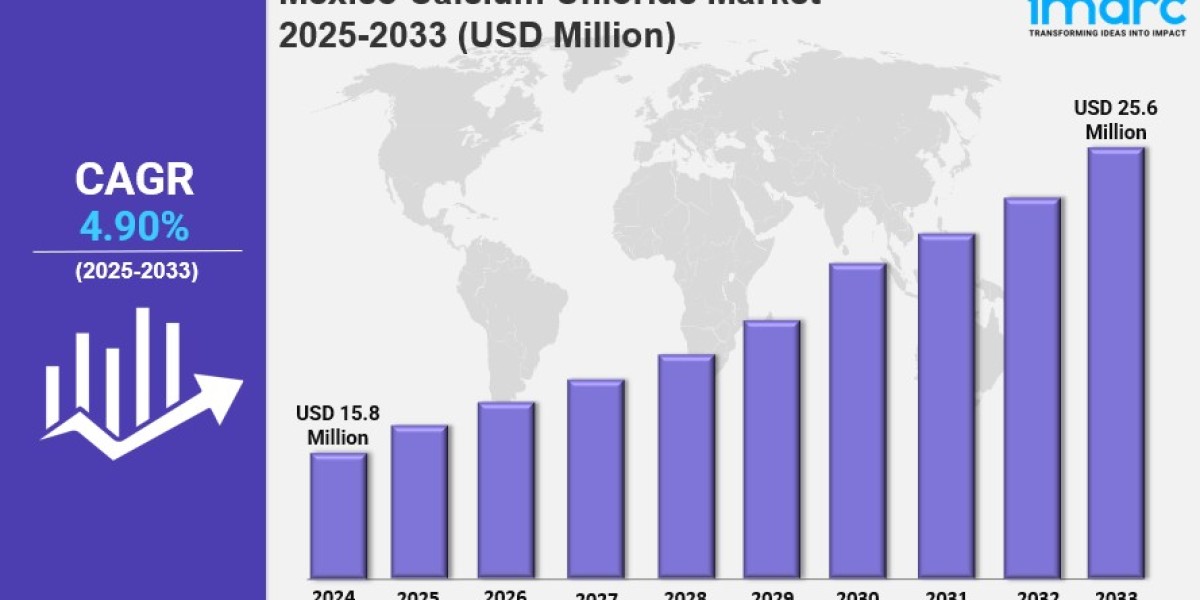

The Mexico calcium chloride market reached a size of USD 15.8 Million in 2024 and is projected to grow to USD 25.6 Million by 2033, reflecting a CAGR of 4.90% for the forecast period 2025–2033. The market growth is driven by rising investments in oil and gas exploration and production, expansion in infrastructure and construction projects, and increasing demand for dust suppression in semi-arid regions.

Study Assumption Years

Base Year: 2024

Historical Year/Period: 2019-2024

Forecast Year/Period: 2025-2033

Mexico Calcium Chloride Market Key Takeaways

Current Market Size: USD 15.8 Million in 2024

CAGR: 4.90% during 2025-2033

Forecast Period: 2025-2033

Growing exploration and production activities in Mexico's oil and gas sector are increasing demand for calcium chloride in drilling fluids and wellbore stabilization.

Significant infrastructure development supported by both private and government investments is boosting calcium chloride use as a concrete accelerator.

Calcium chloride's hygroscopic properties make it effective for dust control and road stabilization in Mexico's arid and semi-arid regions.

Mexico's real estate market is expected to reach USD 237.1 Billion by 2033, supporting growth in construction applications.

Although de-icing applications are limited geographically, they contribute to stable base demand in higher altitudes and cold snaps.

Sample Request Link: https://www.imarcgroup.com/mexico-calcium-chloride-market/requestsample

Mexico Calcium Chloride Market Growth Factors

Mexico Calcium Chloride Market growth is being driven by the country’s increasing investments in oil and gas exploration and production, which are boosting demand for calcium chloride in drilling and well completion applications. The chemical plays a vital role in drilling fluids, completion fluids, and cementing by stabilizing shale formations, improving wellbore stability, and maintaining hydrostatic pressure. Developments in offshore reserves in the Gulf of Mexico and regulatory reforms such as energy sector liberalization, along with international company participation, are stimulating demand. For instance, Talos Energy Inc.'s 2024 success with the EW 953 well and involvement in the Sebastian prospect exemplify ongoing oil industry modernization boosting market prospects.

The construction sector is another key factor driving calcium chloride demand in Mexico. Both private and government investments are propelling growth in infrastructure, housing, and commercial buildings. Calcium chloride is widely used as a concrete accelerator, particularly valuable under low-temperature conditions prevalent in northern Mexico, enhancing curing time, compressive strength, and resistance to cracking. This industry expansion aligns with projections that Mexico’s real estate market will reach USD 237.1 Billion by 2033, underpinning sustained calcium chloride consumption.

Calcium chloride's efficacy in dust control and road stabilization further supports market expansion, especially in semi-arid and arid northern regions with many unpaved rural and industrial roads. Its hygroscopic nature helps absorb moisture to suppress dust, improving air quality, visibility, and operational efficiency in mining and quarrying, where it is also used for road stabilization. While de-icing demand is limited, niche applications during cold snaps and higher altitudes add to the steady base demand alongside dust control requirements.